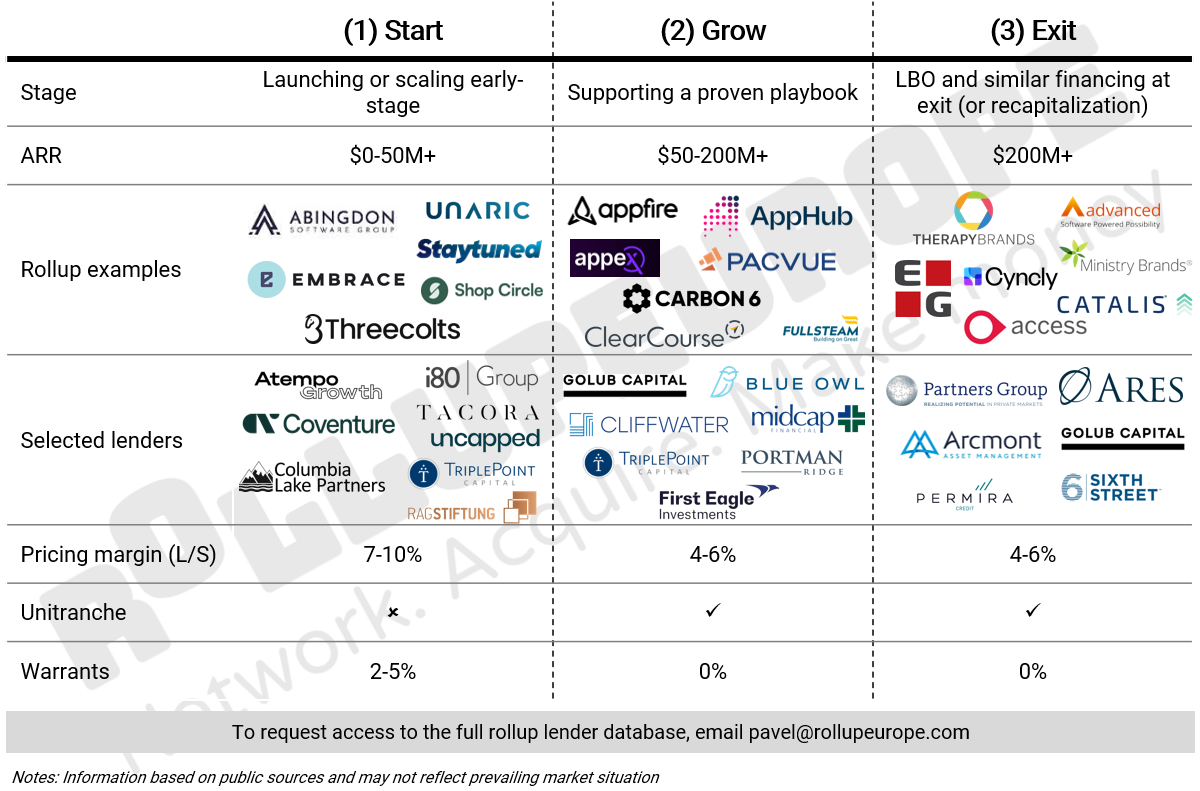

Previously, we have written about the equity investor landscape and the playbook for securing venture debt for those of you starting out.

Rollup Fundraising 101. The patient capital writing big checks

Rollup fundraising 101. Guest post: How to raise growth/venture debt?

Here’s a question we get a lot: What happens next? When the initial $20-30M credit line has been exhausted. When the margin attached to it no longer adequately reflects the risk profile. Who do you call?

Pro tip: you can find lender contacts in Pavel’s Linkedin post.

The market’s come a long way

The good news is that the private debt landscape has evolved to a point where most use cases can be catered for. We have identified two dozen funds that maintain exposure to the industry. Note that we limited our analysis to software rollups only, filtering out other types of consolidators, such as Fulfilled by Amazon (FBA), agencies, wealth managers and accountancy firms.

We are aware of 50+ lenders that are actively exploring the software rollup space.

The higher end of the market is heavily represented by behemoth US firms like Ares and Sixth Street. Anecdotally, we are hearing that a number of funds are reassessing their exposure to rollups in general given the subpar performance of the FBA loan book.

Amazon ‘Aggregators’ Who Raised $16 Billion Are Teetering

The smaller end is more diverse and has several relative newcomers from Europe, like Atempo and Claret. They do not appear to be as much affected by the FBA meltdown as the larger players. They did not have the funds to go crazy in the first place. Plus their small size is a natural hedge as they get taken out.

It helps to be PE backed

Broadly speaking, all rollups fall in either of the two categories: sponsored (meaning backed by a major private equity firm) and non-sponsored, or independents. Unsurprisingly, the independents are finding it challenging to upsize right now, often having to put up incremental equity for each new debt tranche.

As the Head of Europe of a major US credit manager put it to me:

“There has been a paradigm shift. 2 years ago the base rate was zero and the margin was 500 bps. Today, the base rate is 400+ bps and the margin is 600-700 bps. We can achieve the 10%+ target return without breaking a sweat, just through large-cap LBOs. We’re talking about lending to $100M+ EBITDA businesses backed by “AAA” sponsors”

There are success stories too. Shop Circle successfully upsized its debt facility earlier this year, moving from Triple Point to i80, a US private debt fund backed by ICONIQ. Platforms whose founders have deep relationships in the financing world that can convert those relationships into attractive spreads.

Look out for the newcomers

As independent rollups continue to proliferate while risk-adjusted spreads remain attractive, two distinct types of lenders are stepping up to the plate.

One, i80 and its specialty lender “brethren” like Fasamara, Pollen Street Capital and Atalaya have all looked at software rollups but so far have committed limited capital given the lack of tangible collateral they are used to lending against. On the plus side, since bread and butter is consumer lending, they are comfortable with the level of churn common in PLG software.

Two, banks with an appetite for venture debt, such as Santander, Deutsche, JP Morgan and HSBC. The last two names are particularly well positioned having absorbed SVB’s assets and expertise.