Why is this important?

Since 2022, we have witnessed a substantial influx of capital into the rollup space, with strong support from venture capital (e.g., Threecolts, Shop Circle, Unaric) as well as private equity firms and their “alumni” (Everfield, Tiugo, Big Band, Relay Commerce). Sometimes both (Abingdon Software). Considering that the US software rollup industry is well established – to the point where it boasts multiple $1B+ exits – it’s valuable to explore lessons learnt.

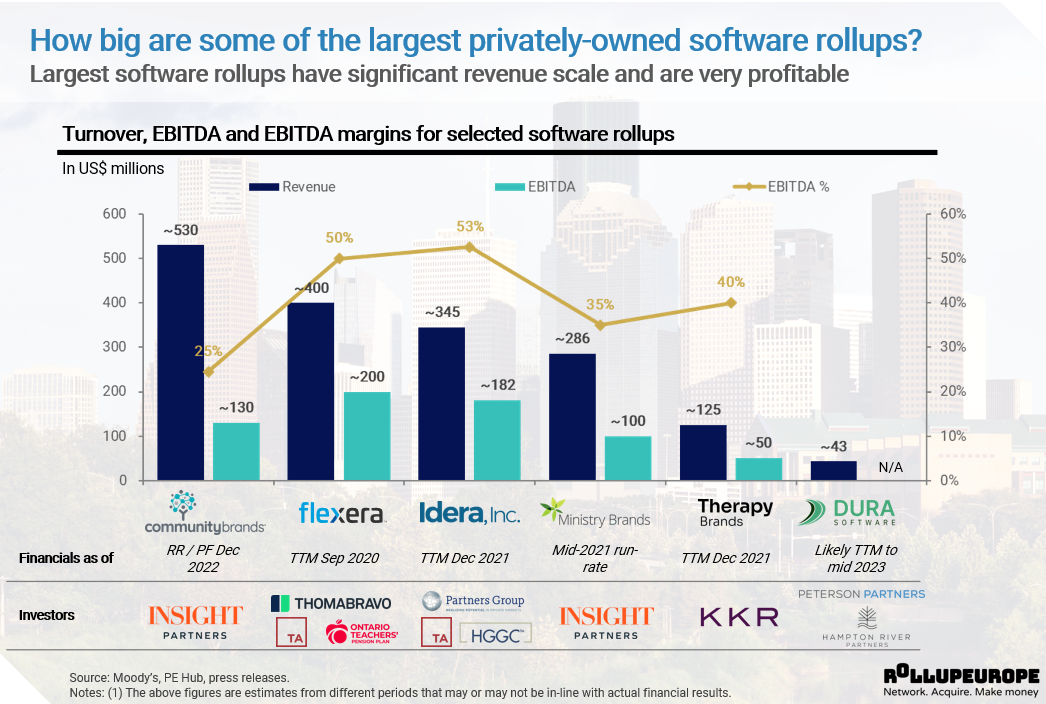

After profiling Therapy Brands (Hell of a therapy session! Why did KKR pay $1.25B for Therapy Brands?), we turn our attention to Idera – a Houston, Texas-headquartered federation of solutions that help database and system administrators, as well as software developers, improve the overall availability, performance and efficiency of their IT systems.

Idera’s cap table has evolved significantly over the last decade – and so have its financials. Based on publicly disclosed information, its TTM Dec 2021 revenue was $345M with an EBITDA margin of ~50%. On this basis, Idera is one of the largest privately held software rollups:

Idera’s origins

Idera traces its beginnings to 2000, when Tien Gah “Alan” Lee created developer tools under the original JSync product. Around the same time, Rick Pleczko founded BBS Technologies, which produced a line of server backup software products later under the name Idera. In 2003, Rick acquired Tien’s business. Rick’s buy vs. build decision matrix is nearly captured in this 2005 interview:

“We’re always looking for new ideas and products. If it makes more commercial sense to acquire a product rather than build it then we’ll do that”.

In 2013, Rick was succeeded by Randy Jacops, Idera’s former COO, who continues to run the business to this day.

A three-legged giant

Idera’s portfolio spans three divisions: Data Tools, Developer Tools, and DevOps Tools:

- Data Tools include data and database management tools for monitoring, securing, migrating, and improving data systems on-premise, in the cloud, and in hybrid environments.

- Developer Tools include high productivity tools to develop applications using powerful and scalable technology stacks, ranging from C++, Delphi, JavaScript, and Java to Low Code Visual Development platforms.

- DevOps Tools include solutions that help almost 1M users through every step of building, testing, and deploying applications as quickly and efficiently as possible.

Back in 2021, Moody’s predicted that the DevOps segment would drive most of the organic momentum, growing in the low to mid-teens percent range. This compares to an overall revenue growth rate in the mid-single digit range. Not stellar, but not too bad either compared to Constellation’s near-zero organic growth rate!

20+ acquisitions since 2014

Since 2014, Idera has completed over 20 acquisitions across its three divisions. There are two main reasons why brands choose to join Idera:

- Firstly, many of the acquired companies are relatively small and face established, well resourced competitors. When Idera acquired a Melbourne-based analytics vendor Yellowfin, Atanas Popov, the general manager of Idera’s Developer Tools vertical, suggested that Yellowfin “would no longer have to fight on its own” for market share against mighty competitors such as Microsoft’s Power BI, Tableau and Qlik.

- Secondly, unlike most traditional software rollups, Idera actively pursues cross-sell initiatives. For Yellowfin, Idera suggested that: a) FusionCharts was expected to provide new visualization options for the Yellowfin platform; b) WhereScape would provide the opportunity to build in automation capabilities; and c) Idera’s developer tools businesses could accelerate the development of Yellowfin’s embedded analytics features. Impressive thinking!

VC rollover: Austin Ventures, Vector Capital, Silverton Partners and Greylock Israel

Idera’s early backer was Austin Ventures, which invested somewhere around 2004. Subsequently, other VCs joined in, some rolling over equity via acquisitions:

- Precise Software

- In June 2008, Vector Capital acquired Precise Software Solutions from Symantec

- At the same time, 83North (fka Greylock Israel) joined as a co-investor.

- In July 2013, Precise was sold to Idera with Vector and 83North rolling over their equity and Vector’s Robert Amen joining the board.

- Cooper Egg – raised funding from Silverton Partners in 2011 and 2012 before being sold to Idera in 2013.

- In 2014, Austin Ventures, Vector Capital, Silverton Partners and Greylock Israel exited the investment to TA Associates as discussed below.

This situation piques interest because, in today’s landscape, numerous venture capital funds have end-of-life considerations and demand complete exits. The funds that don’t have this constraint have a clear advantage in a rollup context.

TA Associates in, VCs out

In Sep 2014, Idera was sold to TA Associates for an undisclosed consideration. At a time, TA was attracted to Idera due to its position as an emerging leader in the infrastructure software market, led by an experienced management team with a strong track record of driving organic and inorganic growth. At the time of the acquisition, the Company had ~13,000 enterprise clients, a figure that grew to ~20,000 just four years later!

At the time of the acquisition, members of Idera’s senior management invested alongside TA Associates and maintained a significant equity interest in the company, while all the early rollover invested fully exited (Austin Ventures, Vector Capital, Silverton Partners, and Greylock Israel).

HGGC’s $1.1B recap

In May 2017, HGGC, a leading middle-market private equity firm, announced the recapitalization of Idera. The $1.125B recapitalization was done in partnership with TA Associates, and Idera management. Upon completion of the deal, HGGC became the controlling investor in Idera, with TA Associates and management retaining a significant ownership stake. The recapitalization included funding for a pending add-on acquisition.

HGGC was attracted to Idera’s high-velocity, low-friction sales process, and innovative operating and delivery model, helping it add over 5,000 new customers annually. Also Idera’s M&A prowess. According to Neil White, a partner at HGGC:

“After we acquired a majority interest in 2017, we worked with Idera to ramp up the acquisition engine and closed over ten transactions in two years.”

Enter Partners Group

In May 2019, Partners Group acquired a 25% stake from the existing shareholders, with HGGC retaining the majority. The company was valued at ~$2B, or ~50% higher than the previous recap. TA Associates and the management team retained a minority stake.

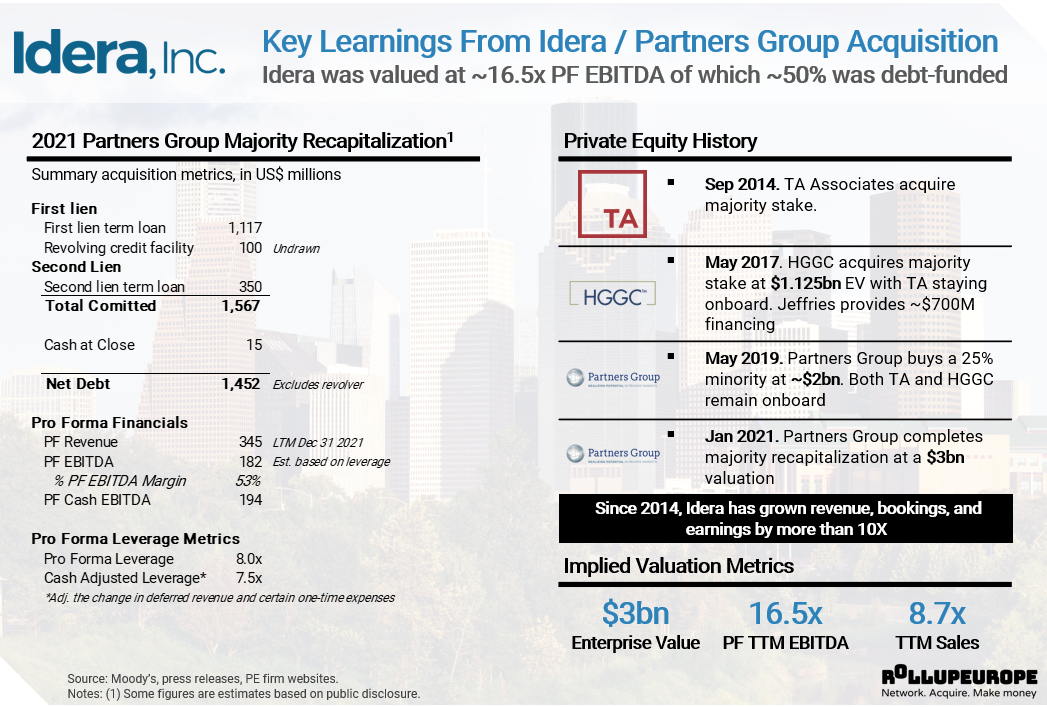

The Finale: Partners pays 16.5X EBITDA, generating a 10X exit for TA Associates

In January 2021, Partners acquired additional equity from TA Associates and HGGC, pushing its stake to 60%, at a valuation of $3B: a ~50% premium to the 2019 recap. At the same time, TA Associates and HGGC rolled over equity into the new investment.

This transaction capped a lucrative journey for both investors. According to PE Hub, TA made a ~10X return on its original investment vs. ~3x for HGGC. At the time of the acquisition, Idera was generating a TTM revenue of $345M with an EBITDA margin of ~50%. Incredibly, in 7 years Idera had grown more than 10X!

Why did Partners pay such a high multiple? To quote Moody’s once more, it is mostly due to high revenue predictability, in turn, supported by:

- High customer retention rates among a customer base that is well diversified across industry and geography; and

- Strong competitive position within the company’s target market for third-party database diagnostic tools and complimentary application monitoring and development products

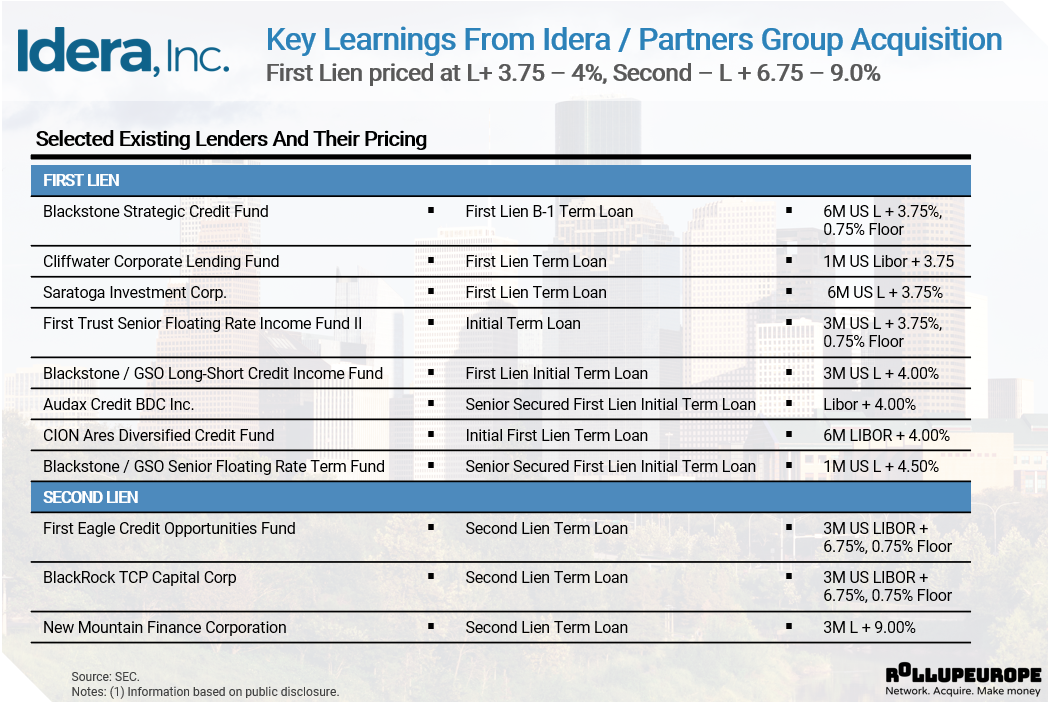

We should add a third factor: availability and affordability of leverage. Partners financed the deal with $1.5B in debt, of which $1.1B was in the form of a first lien and $350M as a second lien. Additionally, lenders committed to providing a $100M revolver. Idera’s pro forma leverage ended up being in the 7.5-8X range.

This sounds like a lot of debt – but perhaps it didn’t back in 2021 when interest rates were at rock bottom. According to SEC filings, Idera is paying on average 375-450bps over the benchmark for the first lien debt; and 675-900bps over the benchmark for the second lien debt.

The lender consortium is rather broad and includes Blackstone, Cliffwater, First Eagle, Ares and others.

TL;DR

- The Idera case study demonstrates that low churn, enterprise-grade software rollups are a highly appealing asset class for mid- and large-cap private equity investors. TA Associates made a 10X return on its 7-year investment in Idera, mirroring the growth the business achieved over the period. A number of other investors achieved healthy gains after rolling over their equity in the companies acquired by Idera

- Partners Group, which recently succeeded the TA / HGGC consortium as the majority shareholder, borrowed heavily to afford the premium multiple (16.5X EBITDA). The fact it was able to pile on 8X leverage is admirable and yet unsurprising, given the propensity of major private lenders to work with sponsored rollups. The capacity for elevated leverage in this, and similar deals is underpinned by a combination of low churn and robust operating margins

- As with Therapy Brands, Idera validates the investment case for staying invested for the long term through equity rollovers, so as to reap the benefits of compounding