Management consultants and other fake prophets

If I had $1 for every inquiry about HoldCo organizational design, I’d be up there with the 1% very soon. Expert networks. Business schools. CEOs. The Twitterati. So many people are flogging HoldCo advice, and yet demand seems to far outstrip supply.

But you know what’s odd?

95% of the content I see focuses on purpose-built HoldCos. Businesses like Roper, Danaher and Constellation.

However, most corporations weren’t built like that. Very few have attempted decentralization – let alone have succeeded with it.

I’ve got just the case study for you: ABB

The best way to describe ABB is a “soup-to-nuts” electric equipment manufacturer. Switches, electrical motors, motion sensors, robots: ABB has got ‘em all. In 2023, it generated $32B in revenue and $4B in net income.

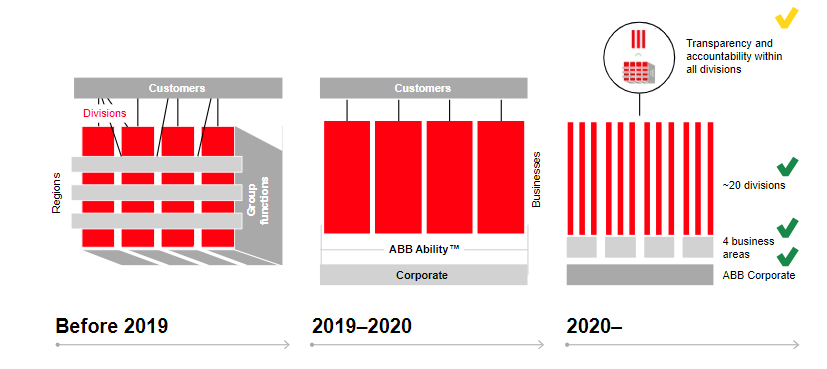

When ABB’s Swedish CEO Björn Rosengren took the reins in 2020, he wasted no time in radically decentralizing the sprawling portfolio as part of his “ABB Way” plan. He didn’t have a choice: ABB was suffering from the “conglomerate sickness”. Its earnings and return on capital were both in long-term decline.

In a detailed presentation from June 2020 Björn outlined key tenets of the ABB Way. For me, this strategy can be summed up in 3 bullets:

- Superior capital allocation by corporate

- Investment decisions taken – and owned by decisions

- Lead HoldCo / HQ

ABB’s decentralization playbook

ABB’s 4 business areas contain 20 divisions. These divisions became the highest operating level in the group. Here’s a catch: to be an ABB division you need to be either #1 or #2 in a market with an attractive profit pool.

There’s a clear delineation of responsibility:

- HQ focuses on portfolio evolution, capital allocation, performance management, common policies and the brand

- Business areas focus on governance, operational performance and portfolio management of their divisions

- Divisions take care of everything else – including partnerships and start-up investments with $20M limits

M&A is led by divisions and business areas. After years of pruning the portfolio, ABB is back on the acquisition trail, with c.100 targets closely monitored. It closed 4 deals in January 2024 alone!

ABB’s take on The Lean HoldCo

At the 2023 Capital Markets Day, ABB guided to <100bps variance between Operating (i.e. divisional) EBITA and EBITA margin as from 2025. This compares to an average 470bps in 2018-22 and 130bps in 2023-24.

Why does this matter?

Let’s look at the ROCE/ROIC formula. The numerator is operating profit (or EBITA). The denominator is the capital invested.

It’s logical to pare back HQ costs (which benefits EBITA) when so much responsibility is shouldered by divisions. This approach eliminates the “HoldCo overhang” which we discussed in this article. In short: divisions are squeezed for cash flow, which is squandered for vanity projects promoted by group management.

Secondly, ABB announced that goodwill will now be carried by each operating division. This should considerably reduce the gap between Operating ROCE and Group ROCE, and allow for more informed capital allocation.

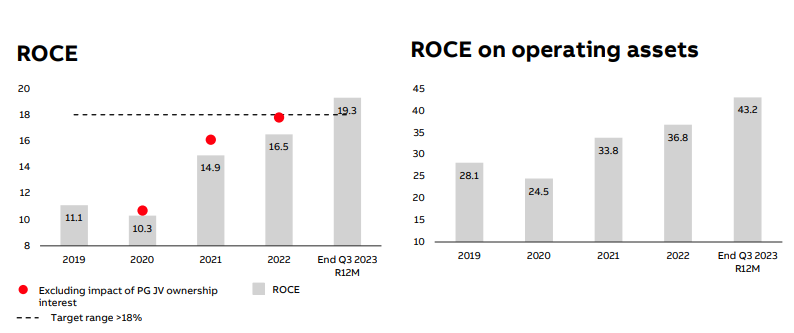

What about measurable impact?

Since ABB Way was introduced, ABB’s market cap has doubled from $40B to $80B. Clearly, share price performance attribution is not straightforward given the tailwinds from electrification.

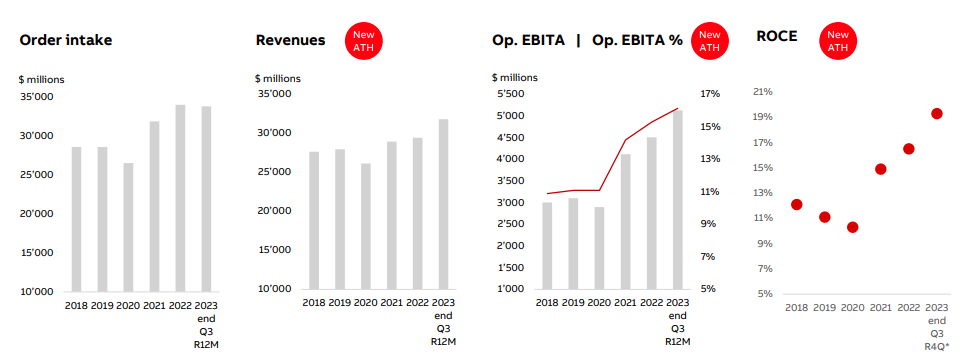

Still, ABB’s financial metrics have undeniably improved. Orders are up. Gross margins are up. Overheads are down. It’s pumping out 20%+ ROCE.