At RollUpEurope, we mostly write about software. That said, our calling card is first and foremost entrepreneurship through acquisition. It doesn’t really matter what type of industry you are consolidating – as long as you are creating shareholder value in a sustainable manner. SaaS, Youtube channels – or wood pellets, for that matter. Which brings us to Graanul Invest: an Estonian biomass producer that has navigated formidable obstacles to achieve a $1B+ exit to Apollo Global Management.

What is Graanul Invest?

Most of our readers are familiar with Estonia and its technological prowess. Less known is the fact that Estonia is an energy powerhouse. It is the only country in the world to have commercialised large-scale extraction of oil shale, which supplies over half of its electricity generation.

Estonia also boasts the EU’s 4th highest forest cover, at 54% of total area. The neighbouring Latvia comes 5th, at 53%. And Graanul Invest found a way to get all that biomass to global markets.

In under 20 years, Graanul metamorphosed from a startup to Europe’s premier wood pellet producer, commanding an annual production capacity of 2.7 million tons. That’s over 10% of Europe’s consumption, and enough to fill the Wembley stadium in London.

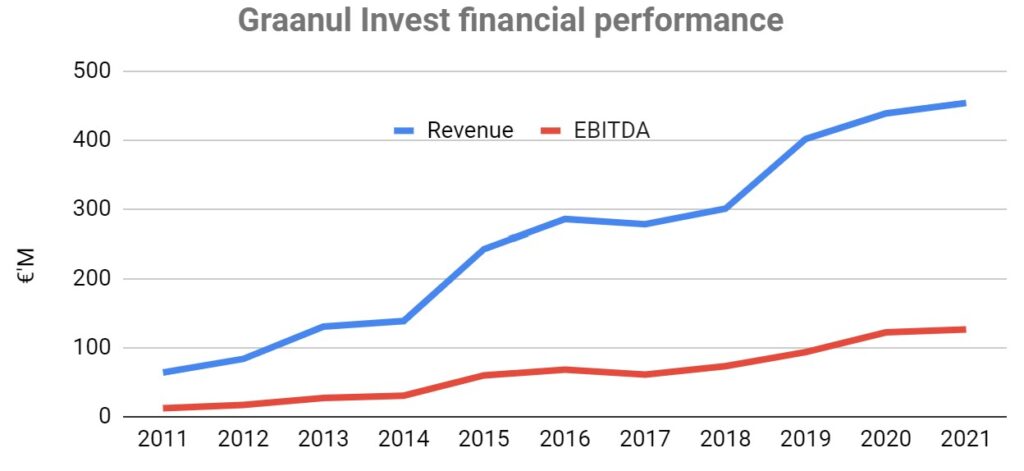

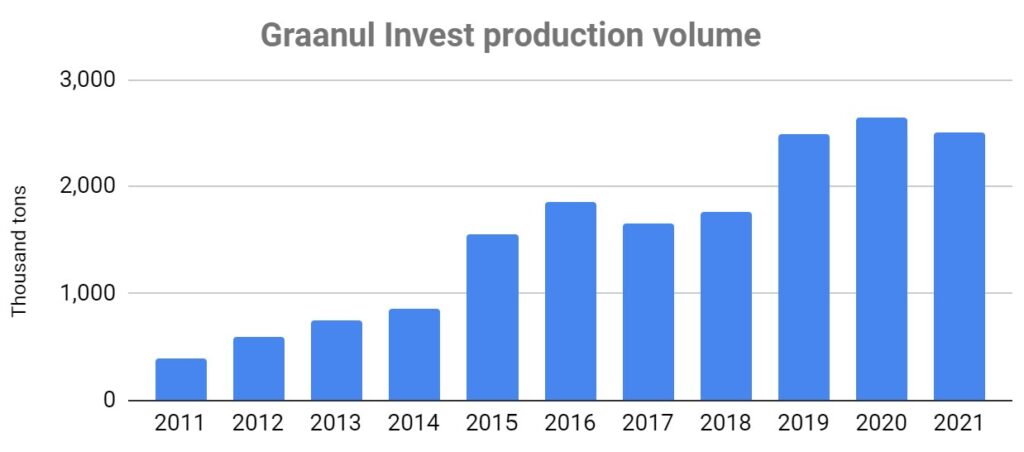

In 2021, Graanul generated revenues of €454M ($537M) with an EBITDA of €126M ($149M): a healthy 28% margin. Looking back, the business had delivered 10-year (2012-21) CAGRs of:

- Production volume: 16%

- Revenue: 18%

- EBITDA: 22%

How did Graanul achieve such an extraordinary feat without tapping institutional investors along the way, or being picked off by the larger, better funded competitors?

Read below!

Lesson #1: Disciplined M&A

From the outset, Graanul sought to accumulate production capacity in the belief that demand for biomass would keep surging. That bet has paid off. Between 2010 and 2020, Europe’s (incl. the UK) pellet consumption had more than tripled.

Along the way, Graanul focused on not just locking up supply from key producing regions (particularly Northeastern Europe and Southeastern US), but also on vertical integration, including:

- Building combined heat power (CHP) plants next to production facilities to reduce energy costs

- Securing feedstock supply i.e. forests

- Securing distribution i.e. ports and cargo ships

| Asset | Year | Rationale |

| Delcotek | 2006 | Estonian pellet producer, ~52 KT capacity |

| 2007 | Two investors acquire a 20% stake in Graanul | |

| Pellest | 2007 | Estonian pellet producer, ~12 KT capacity |

| Hansa Graanul | 2008 | Estonian pellet producer, ~120 KT capacity. Bought out of bankruptcy |

| Fulghum Graanul | 2008 | JV with Fulghum Fibers Inc., a Georgia US based pellet producer |

| Valga Puu (50%) | 2010 | Estonian forest holdings |

| Latgran | 2015 | Latvian pellet producer, ~0.5 MT production capacity |

| Langerlo | 2016 | Acquisition of a 556 MW coal-fired power plant in Belgium with a view to be converted to pellets, following the bankruptcy of its previous owner, German Pellets |

| Karo Mets (50%)

Roger Puit (50%) |

2016 | Estonian forest holdings |

| Texas Pellets | 2019 | ~450 KT manufacturing capacity manufacturing plant and port terminal in Texas. Bought out of bankruptcy |

| Vessels | 2018-22 | Acquired 3 bulk carriers designed to transport a total of ~70 KT pellets |

The picture that emerges from analysing these transactions is of a highly disciplined, patient acquirer. As Raul Kirjanen, Graanul’s founder said in the aftermath of the Texas Pellets transaction: “We have been looking for a suitable opportunity to start pellet production in the US for over 10 years”.

Lesson #2: Stay under the radar, keep 100% of equity

With consistent (and growing) profitability, Graanul’s three shareholders managed to retain full equity until the sale. After the sale, they held onto a 20% stake, as well as 100% of Graanul’s substantial forest and biochemical portfolio, valued at €105M.

Lesson #3: Long-term contracts with blue-chip customers

The majority of Graanul’s sales are through long-term (4-5 years), take-or–pay contracts with European utilities, such as Drax, RWE and Orsted. All 3 have been Graanul’s clients for more than a decade. While Graanul’s contracts tend to be on a shorter side compared to its competitors, such as Enviva (13+ years), this allows for more frequent pricing renegotiation.

Lesson #4: Block out the noise

Graanul’s sale coincided with the post-COVID ESG bubble, since amplified by the Ukraine war and its knock-on effect on European energy supplies.

And yet in many ways it’s the epitome of a long-term investor.

Graanul’s growth from 2013 onwards has been closely linked to Drax’s conversion of the UK’s largest power plant from coal to biomass. The 15-year old subsidy scheme granted to Drax has been dogged by controversy due to its sheer cost (estimated at £11B / $14B). Regardless, Graanul has stood by the client, ramping up capacity to satisfy its growing needs.

Graanul’s attempt to replicate Drax’s model elsewhere however was less successful, as witnessed from the Langerlo plant debacle.

Lesson #5: Maintain allure for PE

The Apollo acquisition was financed with €630M in debt or ~5X EBITDA. The business had not been heavily leveraged to begin with, but as this Fitch report explains, it had all the properties of a successful LBO candidate:

- Growing operating margin

- Solid earnings visibility stemming from long-term contracts with B2B customers

- Inflation hedge: majority of contract have shipping and a raw-material cost pass-through mechanism or fixed-price escalation clauses

- Integrated supply chain

- Demand for product boosted by regulatory initiatives

Learnings for software rollup investors

- Leverage your competitive advantage

- Sell to to blue-chip enterprise customers on long-term contracts

- Pursue vertical integration to protect your market share

- Minimise dilution, keep leverage in check – and stay under the radar