- RollUpEurope

- Posts

- Missed out on crypto, tempted by AI rollups? 2 leading VCs explain the latest craze - and why it’s here to stay

Missed out on crypto, tempted by AI rollups? 2 leading VCs explain the latest craze - and why it’s here to stay

Jokes aside: a primer on which industries are ripe for AI rollups - and how to market yours to VCs

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

It’s September. The summer’s over and it’s time to get back to work! In less than a week, we will be hosting 170 operators, investors and advisers at the “AI in Rollups” Deal Summit. Over an afternoon in East London, we will explore topics such as:

How top investors evaluate AI powered rollups

What do those AI rollups actually do

Last, but not least, I will be hosting a fireside chat with Joakim Karlsen, a co-founder of Hawk Infinity - the breakout Norwegian HoldCo Hawk Infinity which we recently profiled.

Unlike our previous events, this one sold out weeks ago, with people flying in from all over the world. What’s happening? Why is everyone so excited about “AI powered rollups”? And what does this phrase even mean?

Not wanting to be embarrassed on the 10th, I asked Deal Summit panelists Cyrus Hessabi and Sahil Patwa to get me up to speed. As two of the leading investor voices on the topic, Cyrus and Sahil had no problem answering my two questions:

What’s an “AI powered rollup”?

Which industries are most - and least - suitable for AI rollups ?

Now, this wouldn't be a RollUpEurope publication if I didn't offer my own take - which you will find at the end of the article.

Q1: What’s an “AI powered rollup”?

AI powered rollups are technology companies that literally acquire distribution - through M&A. As Sahil put it, “in many sectors, selling software alone might not be the most effective route to value capture. The better play might be to go full-stack - offering the service itself, powered by proprietary software”.

Now, vertical integration isn't a novel concept. Commodity trading firms like Glencore and Trafigura have been doing this for ages, gobbling up assets both upstream (oil wells) and downstream (gas stations) to cement their market positions.

Fundamentally, for most rollups, the end game is market domination. This isn't only about buying up competition: it is also about standardising commercial practices across a portfolio of businesses. We are talking about initiatives like:

Increasing client density to maximise engineer utilisation

Being laser-focused on higher gross margin products / services

Driving cross-sell

We have seen this in fire safety. In anesthesiology. In car repair. In HVAC. In car washes. I can go on and on!

However: with the exception of car washes, none of these rollups have fundamentally altered the underlying service. AI rollups are different because their raison d’etre is exactly that: to reinvent service delivery. So radical is their approach, these AI rollups tend to run on proprietary tech stacks.

Q2: Which industries are most - and least suitable for AI rollups?

With the existential question out of the way, Sahil and Cyrus pulled out their industry selection frameworks.

Sahil’s framework contains 9 points:

Source: Sahil Patwa

Importantly, Sahil distinguishes between AI use cases in “PE plays” and “VC plays”. Cost-saving focused AI tools are great… but not enough to get the VCs excited. For that, you must be able to demonstrate accretive impact at revenue and gross margin levels.

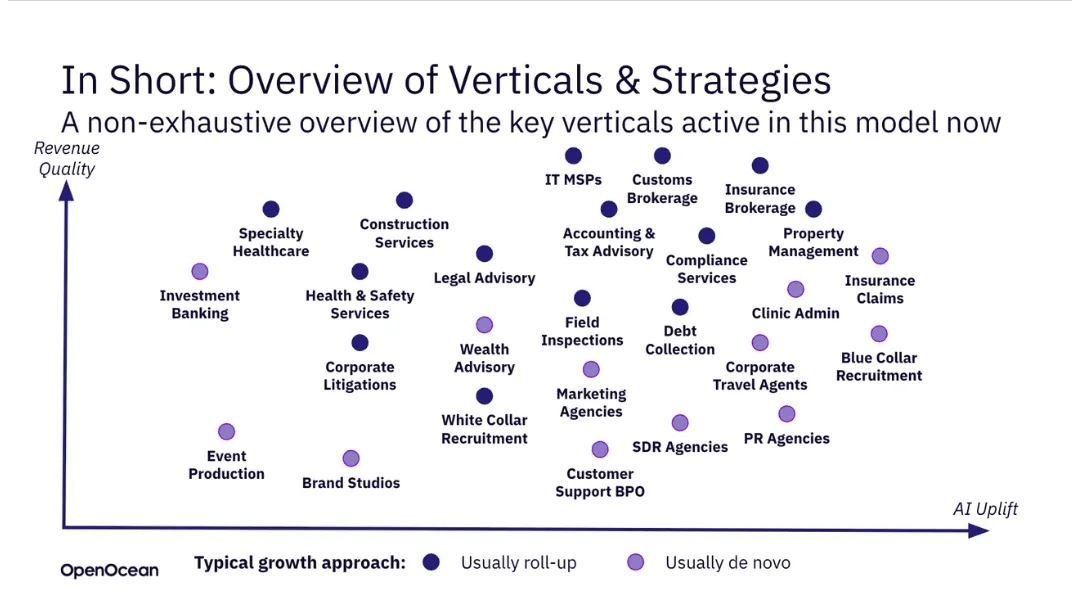

Cyrus offered a slightly different angle, by weighing up industry revenue quality against AI uplift. As the first step, find industries characterised by a) high quality revenue (recurring, high cash generation) and b) high volumes of repetitive, labor-intensive workflows. Then, automate these workflows with AI, so as to unlock genuine productivity gains for human employees (more customers served per FTE etc.).

Hang on, but if the underlying product is so revolutionary, doesn't the company have more routes to market than M&A?

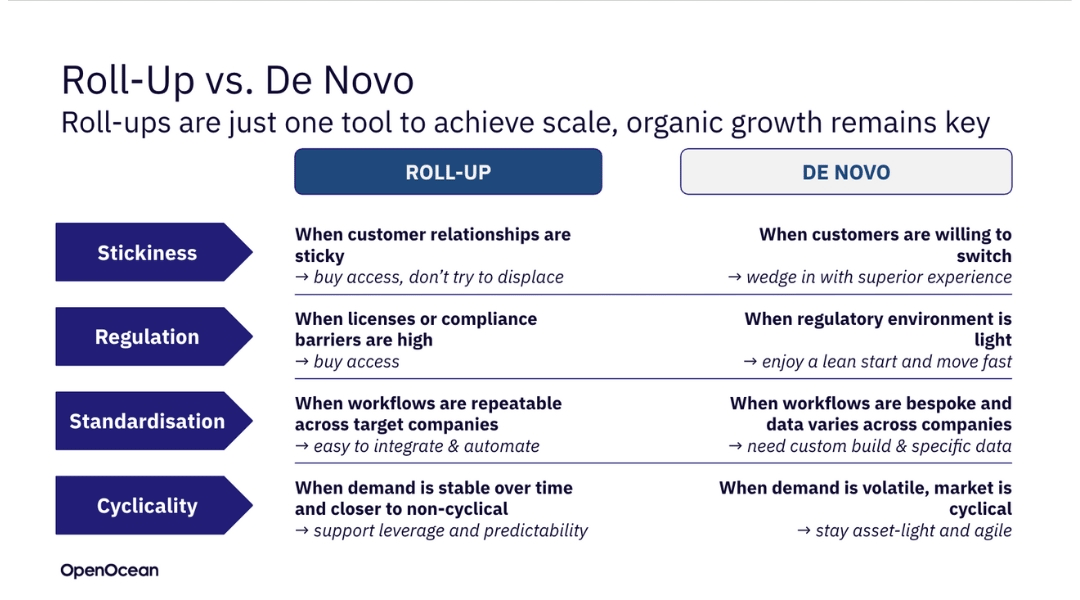

Correct, says Cyrus. Rollups work best in sticky, regulated, standardised, and non-cyclical verticals. Whereas “de novo”, or organic strategies work best in agile, lightly regulated, fragmented, and volatile verticals.

Source: Cyrus Hessabi

I can't speak for the majority of the industries, but as a former FIG investment banker, I can attest that mergers haven't created much value in IBD or in Wealth Management.

With one important caveat: scale.

Little known outside the UK’s Wealth Management industry, True Potential is one of Europe’s most successful fintechs. It has compounded revenue and Assets under Administration by 40% per year... for over 15 years. True Potential’s secret? Avoiding big-ticket deals and focusing on buying small books of business from retiring advisers. Plus ruthless optimisation.

Source: Cyrus Hessabi

But hang on Cyrus, let’s say you’ve got two SaaS companies in your portfolio. Both claim superior products for under-digitised, but otherwise solid industries. Both are bleeding cash. The root cause: recalcitrant customers.

In this situation, how does one decide between a) writing off the investment and b) doubling down i.e. backing a pivot towards an AI-powered rollup?

Exhibit A: Buena. A German aggregator of residential property management companies (“Hausverwaltung”). Buena 1.0 was a Vertical Market Software vendor to the Hausverwaltung industry.

On the surface, everything looked great. According to Ralph, Buena’s competitor, the markets for Building Management and Rental Management are €7-8B, each. The long tail? Hell yeah! According to this ranking, Germany’s 20th largest Hausverwaltung has €52M in revenue - less than 1% market share!

And yet, Buena hit the rocks. In a Linkedin post the CEO explained what went wrong:

Source: Linkedin

In 2023, Buena switched to a rollup model, made 20+ acquisitions, and voila - bagged a $58M check from Google Ventures and other brand name VCs (source).

If the pivot is that easy, how come everyone isn't doing that?

To quote Cyrus:

“When you are selling software into an industry where significant customer education is required for adoption and retention, or where switching costs are high, you can end up paying a lot in Sales & Marketing or customers that might still churn or not provide that much lifetime value. It might make more sense to just buy the customer base (i.e. distribution) and deliver the service through your technology”.

Alex’s take on the AI rollup craze

A year ago, the sheer idea of VCs backed lower mid-market rollups struck me as preposterous. Today, I’m not so sure.

Working through the German Hausverwaltung case study, I realised that Cyrus’ and Sahil’s frameworks could benefit from two additional variables: regulation and scale.

A shift in regulation can act as a powerful catalyst for value creation, for example, by enabling fully or predominantly digital service delivery. The 2020 reform of the German Condominium Act considerably simplified the business of managing residential properties, by providing for digital invitations, assemblies and voting - plus lower threshold for decision-making and expanded autonomy for the managers.

The industry is run by folks near / at retirement age. They read the news, shrugged - and carried on the old way. A textbook example of an industry “where significant customer education is required for adoption and retention”.

Before the Act, I don't see why anyone would want to run a property manager in Germany. After the Act, I’m tempted to buy one myself!

I’m not the only one. As the Act’s transition period ended in december 2023, a dozen upstarts including Buena, Ralph and Hello Theo are busy scouring the market for bargains. Anecdotally, the supply is plentiful and the multiples remain modest - between 0.6x and 0.8x of revenue. But so is the typical target: €500-600K revenue.

Which brings me to my second point - and the final point of this article.

As long as AI powered rollups focus on the long tail, they will face little competition from Private Equity or from Independent Sponsors. Of course, there is a risk that the ambitious boys and girls that inhabit the AI rollups will eventually tire of six figure acquisitions. At that point, they have three options. 1, compete with PE head-on. 2, sell their product to PE. 3, sell themselves to PE.