- RollUpEurope

- Posts

- Peak Leonard or AI Hedge? 3 existential risks to Constellation Software in the Age of AI

Peak Leonard or AI Hedge? 3 existential risks to Constellation Software in the Age of AI

What can we learn from a $5M revenue, 36 year old French revenue water billing VMS?

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

ChatGPT turns 3 on November 30th! The Grim Reaper of horizontal SaaS and consumer applications, it has claimed the scalps of countless household names like Shutterstock (share price -52% in 3 years), Coursera (-25%) and Gartner (-28%).

The list is bound to keep growing.

Even the erstwhile stock market darling Monday.com suffered a painful de-rating after linking Google’s new AI search features to reduced inbound funnel activity from SMB customers.

Horizontal SaaS is highly susceptible to the AI risk for two main reasons:

One, with the advent of vibe-coding, the underlying product can be cheaply replicated and sold to millions of customers.

Two, for a lot of horizontal SaaS, the default Go To Market motion is Product Led Growth, or PLG. This heavy reliance on Search Engine Optimisation to drive customer signups has now become a vulnerability. In September, Google disabled the hidden “&num=100” parameter - used by SEO tools and AI scrapers to pull 100 search results at once - dramatically shrinking bot-accessibility (detail) and making it harder to stay on top of ranking.

Vertical Market Software - and the acquirers of VMS businesses, like Constellation Software (CSI), Roper, Topicus and others - do not face the same risks because:

They each own hundreds of unrelated software products, each targeting markets that are small and often stagnant

These products are mostly vertical and mission critical. The sales cycles are long and the clients are reluctant to switch vendors: a “bug” as well as defensive feature in the Age of AI

If your dream is world domination dethroning Oracle NetSuite (revenue: $4B, growing 16% YoY), why on earth would you go after CSI’s businesses like the French water billing VMS INCOM (revenue: $5M, growing 4% YoY - more on that below).

But, as Guns’n’Roses sang in their 1991 rock ballad November Rain (look it up on Spotify and enjoy the guitar solos!), “Nothing lasts forever, And we both know hearts can change”.

Even a change in investor sentiment can be damaging as it may scare off prospective targets and employees. CSI management knows this all too well. Last month, a botched investor call about AI sent its shares down 5%!

For now, CSI appears to defy the apocalyptic predictions made by SaaS influencers like Greg Isenberg, who warned that "50% of SaaS companies will die". There is no way of knowing if Greg is right. Even if he was, the better question to ask is which 50% will survive.

We argue that CSI belongs in the latter category, and we are going to explain why. Specifically, we will go over topics such as:

What exactly are the “AI risks” facing Constellation Software?

What can we learn from a $5M revenue, 36 year old French revenue water billing VMS?

CSI’s 3 existential risks - dissected

Our conclusions

If you want to get up to speed on Software Serial Acquirers as a category, check out our Software Gym: a collection of 30+ articles covering everything from acquirer primers to deal origination best practices!

1. What exactly are the “AI risks” facing Constellation Software?

We believe that AI presents two existential risks to CSI’s business model:

AI makes software development easier, thus creating more competition for CSI's products

AI changes the way end clients work, reducing or even eliminating the need for CSI's tooling

We’ll double-click on both these risks, as well as a third, non-AI risk.

Our loyal readers know that we have written extensively about CSI, including: how it squeezes cash from portfolio companies; bags $100M+ targets for 1x revenue; and ultimately wins deals and keeps talent - while remaining ultra-frugal.

A 30-second summary of CSI’s strategy goes like this:

Acquire mission-critical software businesses that dominate very small markets (TAMs as low as $10-20M)...

…cheaply (1x revenue on average)...

…and ruthlessly optimise internal resources and cash flow.

Let’s get specific. In 2021, Volaris - a division of CSI - acquired INCOM: a French water billing Vertical Market Software. We will use this example to illustrate the practical challenges of disrupting CSI portfolios, one business at a time.

2. What can we learn from a $5M revenue, 36 year old French revenue water billing VMS?

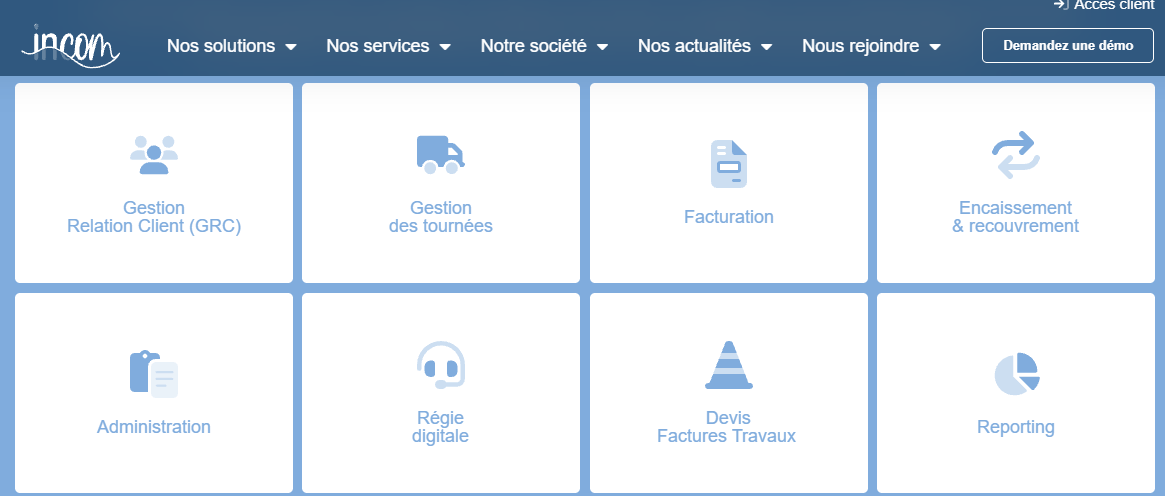

Founded in 1989, INCOM caters to the "Régie" market: where water supply is managed by local authorities rather than outsourced to private companies like Suez or Veolia. In FY 2023, INCOM generated €4.7M in revenue with €0.6M in EBITDA.

Tiny as it is, INCOM is a Top 3 player in a market worth approx. €20M, based on our discussions with former Volaris employees. Other key players include Somei, JBA-Soft and Berger-Levrault.

Source: INCOM website

What is the likelihood of an AI upstart disrupting INCOM? In our opinion, extremely low - for 4 reasons.

First of all, INCOM is barely growing. And so is the underlying market.

Secondly, water billing is not a profit center, or a market where you can expand through volume growth. New clients are hard to come by. Business development is a zero-sum game.

Thirdly, INCOM’s customer base is risk-averse. Iamgine you run the IT department of a provincial town in France. You’re not going to screw water supply - and your career prospects by churning through SaaS vendors, are you? At the same time, you may request a few tweaks to the software. And that’s what INCOM does well. In 2023, professional services represented 1/3 of revenue. It’s nigh on impossible to disrupt a product that is being endlessly customised!

Fourthly, unlike Monday.com’s standard project management features, INCOM’s customer requirements are confidential and cannot be “vibe coded” outside-in.

And we’re not even talking about protective features like multi-year contracts and public tenders!

We can go on…but you get the idea. Users have very little incentive to switch providers, which makes it extremely difficult for new entrants to gain traction - so, they're likely to pursue easier targets instead.

Conversely, the advances in AI may well enable INCOM’s developers to refresh UI/UX; refactor code bases; and accelerate the shift from on-premise to cloud solutions (helping fatten its margins in the process!).

3. CSI’s 3 existential risks - dissected

Alas, not all of CSI's portfolio is bulletproof like INCOM. As CSI (and its competitors) keeps growing, it’s having to deploy an ever-larger capital base. Invariably, this means acquiring more horizontal SaaS masquerading as VMS. Such tools emerge when founders gain early traction in one industry and decide to focus exclusively on it; though the product itself is actually quite standard.

This is where Existential Risk #1 comes into play - if it is easy to vibe-code a similar product, competitors will come. What may appear like deep expertise and lasting advantages may quickly unravel when competition gets their act together!

Exhibit A: CRM for real estate. The CSI owns Constellation1, which comprises a lead-gen tool, an e-signature tool, and even a website builder for realtors!

You heard that right: CSI owns a set of PLG tools arguably inferior to the competition. The competition though has far more aggressive marketing strategies. Sales and marketing is not typically CSI's forte. Sure, Constellation1 proudly displays the Berkshire Hathaway HomeServices on its website - but does that matter in an industry this fragmented?

Another potentially vulnerable division is Jonas Sports, which serves gyms and fitness centres. Why vulnerable? Two reasons. One, there are lots of cloud-native new entrants. Two, the clients work flows (subscription management, appointment management) are simple, with limited customisation required.

Source: Jonas Sports

Let’s talk about Existential Risk #2: CSI's customers themselves using AI to change their ways of working or getting eliminated altogether.