- RollUpEurope

- Posts

- Teamshares wants to dominate America’s SMB succession game - but do the numbers add up? 5 observations after digging through the SPAC docs

Teamshares wants to dominate America’s SMB succession game - but do the numbers add up? 5 observations after digging through the SPAC docs

Inside: Röko vs. Teamshares side-by-side. Warning: not investment advice!

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

Very unusual to see an American company whose comp set is made up almost entirely of mid-cap European stocks. And the stocks in question are battle-hardened HoldCos like Chapters Group, LIFCO, Röko, Lagercrantz and others (and yes, we have covered most of them in the blog).

Even more unusual to see a programmatic acquirer that is not particularly acquisitive, or produces much cash flow.

Teamshares is all of those things – and it’s going public via a SPAC. The SPAC, called Live Oak Acquisition, is affiliated with the investment firm T. Rowe Price (the same investor led Bending Spoons’ most recent round).

In September 2024, we published a deep-dive on Teamshares that instantly became one of our most popular articles: Admired, copied, misunderstood: the incredible story of Teamshares. The equity story at the time revolved around buying Main Street businesses, cheaply, and converting them into captive customers of financial products. Put differently, the end game was not necessarily the companies themselves, but the platform that was being built out.

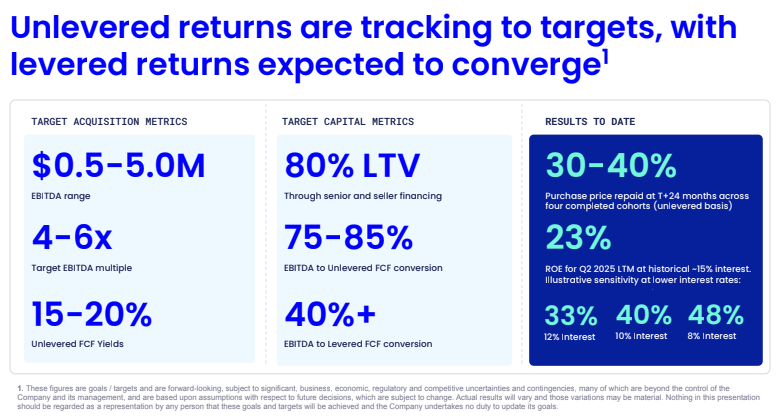

In the year since, the narrative has decisively shifted. The revamped Teamshares pitches itself as a Swedish-style compounder (link to the SPAC deck) looking to ride the US SMB succession wave:

Source: Teamshares SPAC presentation

This volte-face is not necessarily a bad thing.

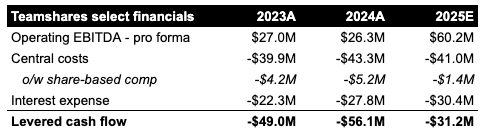

For a while, Teamshares was on a trajectory that looked part Storskogen and part Thrasio (“7 companies closed in a single month” - according to the SPAC deck). A fast-paced but seemingly random M&A strategy (a butcher chain, a design firm, a fast-food restaurant!) overseen by an oversized central team. Despite the makeover, the SPAC presentation shows that Teamshares is still lossmaking (6 years in), weighed down by $40M in annual corporate costs and $30M in interest payments - against only $60M in asset level EBITDA (which is admittedly double last year’s levels).

Teamshares is pricing the SPAC at a 36% discount to the 2024 Series E (source), valuing the company at $525M equity value / $746M enterprise value, with $333M in targeted equity proceeds.

As we await further SPAC docs - basic things like a balance sheet are missing - here are our initial thoughts around:

Revenue growth

Capital deployment

What does a central team do in a HoldCo?

Debt facility

Closing thoughts: implications for serial acquirers

Before we get into the weeds, please remember that all of this is for your education entertainment purposes and based on public information. This is not investment advice.

Teamshares takes pride in sourcing 13,000 qualified leads annually through its software. Whether a search fund, a HoldCo or a PE fund, you don't need to spend millions on proprietary systems. Get Grata: the world’s most comprehensive private market intelligence company.

1. Revenue growth: below prior forecasts

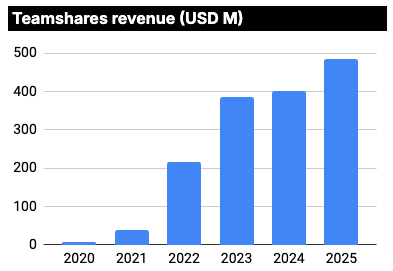

In August 2023, Teamshares had 84 businesses in the portfolio generating $400M in run-rate revenue. The latest stats are 87 and $434M, respectively (LTM to June 30, 2025).

A 2022 investor deck we reviewed projected 2025 revenues of $2.4B with nearly 700 companies in the portfolio. In other words, Teamshares was meant to be adding 200 companies a year.

What happened? Teamshares has clearly divested a number of businesses. A few have failed and shut down. But the larger issue appears to be a lack of capital to pursue M&A since late 2023:

Source: Teamshares filings, RollUpEurope analysis

2. Capital deployment: where did all the money go?

How much capital has Teamshares deployed to date? Hard to say without a balance sheet, but our estimate is north of $500M. We get there by adding:

$152M of debt as at Q2 2025;

the fact that Teamshares generally acquires profitable businesses.

Note: our calculations exclude minority interests tied to employee ownership of the portfolio companies, as this information has not been disclosed.

On that basis, dividing the $500M by the 2025 pro forma asset-level EBITDA of $60 million, yields an implied buy-in multiple of >8x.

This doesn’t sound right, does it?

8x is a lot to be paying for companies with <$1M EBITDA, most of which wouldn’t even register on the radars of search funds or lower mid market PE funds (search funds tend to target businesses with $2M+ EBITDA, as per this Stanford study). And remember: Teamshares assumes 20% seller financing, which should knock roughly a turn off the effective purchase multiple.

An alternative explanation is that Teamshares has been paying 4-6x EBITDA for acquisitions. The gap, at least $200M over 6 years, might be down to two factors:

An expensive central team

An expensive debt facility.

Source: Teamshares filings, RollUpEurope analysis

More on both these points below.

3. What does a central team do in a HoldCo?

Even though Teamshares’ investment thesis has shifted from insourcing an SMB’s entire fintech stack (payments, insurance etc.) to “simply” being an efficient serial acquirer, its central costs (incl. non-cash items, such as share-based compensation) have remained surprisingly static:

$40M in 2023

$43M in 2024

$41M in 2025E.

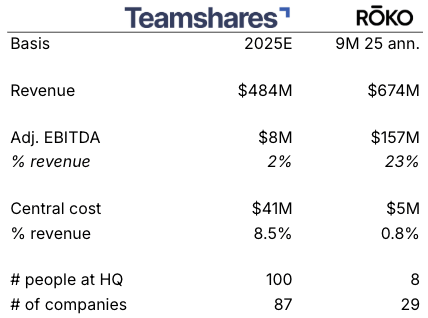

We reckon that Teamshares has a central team of c.100. How does this compare to its aspirational peer group - Swedish programmatic acquirers?

Let’s take Röko for example. Röko manages a c.$670M revenue portfolio with a corporate overhead of just $5M (a team of 8): a ratio of 0.7% (based on 9M 2025 data, annualised). The corresponding figures for Teamshares are $484M and $41M, respectively: a ratio of 8%. In other words, a difference of more than 10x! Admittedly, the sourcing effort is comparable, while the portfolio monitoring effort is lower for Röko, which has half the companies of Teamshares:

Source: public filings, RollUpEurope analysis

What exactly does $40M / year buy you these days?

In the SPAC deck, there’s mention of a scaled-up acquisition platform, but it’s hard to see what that is. “Automated broker outreach”. “AI-assisted investment memo”. “Workflow software for monthly variable FCF sweep“.

Come on, it’s 2025: everyone is doing those things. OffDeal has built an entire AI investment bank.

Meanwhile, Teamshares appears to have cut back the Fintech team, parting ways with divisional leaders including Brad Lookabaugh (VP Financial Products) and Brittany Canty (Group Product Manager).

We are intrigued by the remaining fintech initiatives, like “automated forecasting” and “automated working capital management”. Interestingly, we did not see anything about implementing AI at portfolio companies: a major topic at every SMB M&A conference I’ve been to in the last 18 months.

4. Debt facility: expensive!

Dividing Teamshares’ 2025E interest expense ($30M) by its June 2025 debt balance ($152M) implies a coupon of about 20%. In reality, the coupon is likely a bit lower (17-18%), and the year-end debt balance is probably higher than $152M. These kinds of rates are typical for lenders like Sound Point and i80.

Capital structure is just one area where Teamshares is at a disadvantage compared with smaller competitors. Most U.S. search-fund deals are financed with SBA 7(a) loans, where borrowing costs are capped in the high single digits in today’s rate environment. The trade-off, of course, is the borrower’s personal guarantee.

5. Closing thoughts: implications for serial acquirers

We wish Teamshares best of luck with the SPAC. The world needs more programmatic serial acquirers: patient stewards of capital that carry out the societally vital function of SMB succession.

Alas, buying ‘boring’ businesses consistently is far harder than it looks from the outside. And Teamshares may have tried to do too much, too fast. Its story offers lessons for the new wave of ‘AI rollups’ bent on building smart platforms to reinvent entire industries like rentals and accounting:

Teamshares’ ambitions of platform supremacy now seem reduced to automating buy-side processes and managing cash sweeps. Yet, compared to the Swedish acquirers it seeks to emulate - firms like Röko - Teamshares’ central spend is up to ten times higher as a share of revenue.

One unfortunate consequence of this experiment is the roughly $200M in sunk costs that appear to be tied to corporate expenses and interest payments, versus $300M actually deployed on M&A. (Both figures are our own estimates and should be validated!)

Core insight: be smart about resource allocation.