Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

When I was a kid, I loved sifting through my parents’ vinyl collection. Among the few Western records we owned were the albums by Italo Pop superstars Ricchi e Poveri (pictured below) and Adriano Celentano. I have no idea how these artists made it past the Iron Curtain, but that experience fuelled my lifelong passion for the genre.

Ricchi e Poveri in their 1980s heyday

And even though I'm not counting on an Italo Pop revival any time soon, Italy keeps pumping out cultural icons… of a different kind. Yes we’re talking about Bending Spoons! The Milan-based conglomerate is both Europe’s hottest tech company and its most prolific serial acquirer. The Spoons’ sprawling portfolio of digital real estate holdings includes iconic brands like Vimeo, Komoot, and Evernote… soon also AOL.

The basics of the Spoons’ business model are universally known thanks to the multiple interviews its CEO Luca Ferrari has given over the past year (Invest With the Best / transcript; Sifted profile; the recent Reuters interview):

Cut costs aggressively by a) right-sizing workforce and b) centralising whatever can be centralised (product, payments, SEO).

Switch monetisation model from one-off purchases to subscriptions and/or increase prices

Recycle the resulting cash flows into a) platform build (Bending Spoons told us they have c.50 proprietary technologies) and b) more acquisitions. Repeat!

The model seems to work. Bending Spoons’ early backers have done amazingly well. For example, Tamburi Investment Partners is sitting on a 20x MOIC on their 2019 investment.

But where’s the detail you’re craving?

How have the acquisitions performed? What’s the underlying organic growth rate? How much does Bending Spoons pay for M&A? Crucially, how does one reconcile non-stop acquisitions of tarnished heirlooms like Vimeo ($1.4B price tag for a business generating c.$50M in free cash flow) with Bending Spoons’ $11B valuation?

Don't worry: we've got you covered. Over the last month, we have meticulously researched these and other topics, to give you all the insights. Today, we will cover:

We've read Bending Spoons annual and credit ratings reports - so you don't have to

Acquisition deep dive #1: FiLMiC

Acquisition deep dive #2: Komoot

Acquisition deep dive #3: Mosaic

4 ways in which the Bending Spoons story can evolve: Constellation Software, IAC, Alludo, ESW Capital

Note 1: an advanced draft of this article was reviewed by the leadership team of Bending Spoons. We are thankful for their feedback, and we did our best to correct the inaccuracies they pointed out.

Note 2: for Part 2 of the Bending Spoons deep-dive (published in February 2026), see here: Eventbrite, Vimeo, Brightcove... Who’s next - and can you build a merger arb business out of Bending Spoons’ U.S. take-private rampage?

Before we tuck in, a shoutout to our sponsor TechCredit Partners… THE debt advisor to rollups, HoldCos and Independent Sponsors. If you’re looking for $5M-$100M in debt capital, TechCredit Partners will help you close the optimal deal.

Intrigued? Send an email to [email protected] and they will be happy to discuss your financing needs.

Ready? Let's go!

1. We've read Bending Spoons’ annual and credit ratings reports - so you don't have to

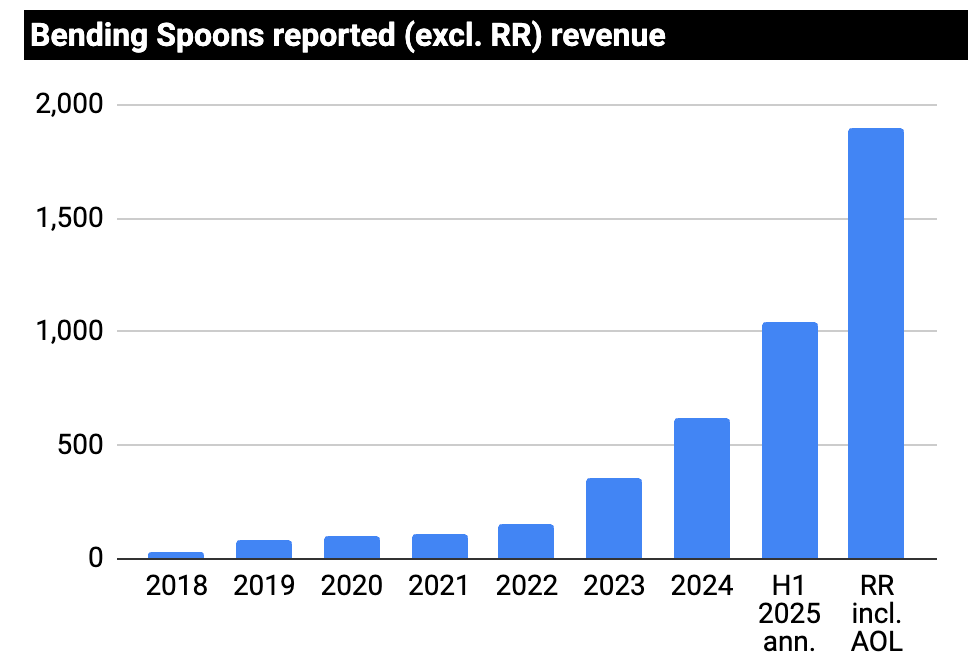

Bending Spoons is one of the world’s fastest growing tech companies. Between 2018 and H1 2025, its revenues grew more than 30-fold, from €30M to €1B. This figure is set to almost double again based on the deals announced in H2 2025.

Source: company filings, Tamburi Investment Partners, RollUpEurope analysis

Bending Spoons is profitable and backed by blue-chip investors such as Baillie Gifford, Fidelity and Neuberger Berman. Still, its debt (Term Loan B) is rated B+: junk. How come?

There are three main reasons:

Reason #1 is the quality of earnings. Throughout 2023, 2024 and H1 2025, Bending Spoons reported adjusted EBITDA margins of 50%. S&P’s forecast for this year is closer to 30%. The delta is due to restructuring costs, estimated at €190M, including €80M for Vimeo alone.

Reason #2 is the high leverage. Pre AOL, S&P was forecasting a net debt / EBITDA ratio of 5.1x by the end of 2025. If it is true that AOL comes with $400M EBITDA but only a $1.5B price tag (source), plus factoring in the recent $270M equity raise, the ratings adjusted leverage ratio is probably closer to 4x. Bending Spoons told us that their leverage metric - which strips out one-off and restructuring costs - is 2.7x pro forma all recent acquisitions.

Reason #3 is the customer base. “Less loyal than that of software companies, with higher risks of customer churn and limited ability to raise prices” (source). Fair, but at the same time the “cigarette butt” jibe appears undeserved. In the 12 months to March 2025, the Spoons’ organic growth hit 5% (source). For 2025 and 2026, S&P expects 3-4%. Bending Spoons told us that, in aggregate, their products have 96% NRR on a blended basis.

Absent new acquisitions, how sustainable is that growth rate? A big chunk comes from Day 1 initiatives like shifting monetisation from one-off purchases to subscription (see the Komoot case study below), and raising subscription prices 2-4x (Mosaic being case in point).

What’s not disputed is that Bending Spoons is throwing off a lot of cash, the heavy restructuring spend notwithstanding. In 2024, it generated €158M in operating cash flow, equivalent to 25% of revenue.

THIS is the key differentiator vs. other rapid-fire acquirers like Thrasio, Teamshares or Storskogen.

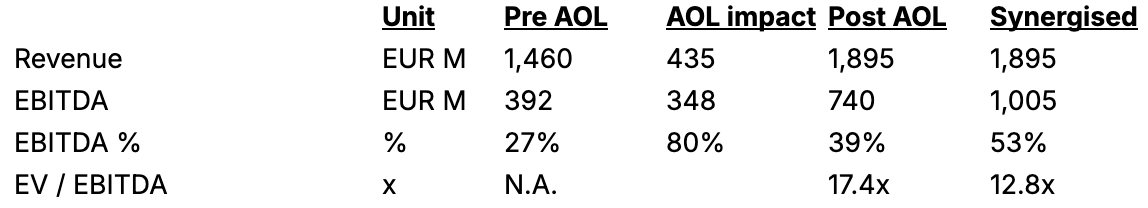

Pre AOL, S&P was pegging its steady-state EBITDA margin at 40%+. Post AOL, we estimate pro forma revenues of €1.9B / $2.2B, with a pro forma EBITDA of €1B / $1.2B. Specifically, we have assumed:

The portfolio ex AOL running at a 45% margin

AOL running at a 80% margin

Source: RollUpEurope estimates

Our bottom-up EBITDA estimates compare to Bending Spoons’ internal projections of €700M and €1.4B for 2025 and 2026, respectively (source). Since we don't have visibility on the M&A pipeline beyond what’s been publicly announced, we'll just leave it here :)

We also know that, pre AOL, Bending Spoons was forecast to finish 2025 with €2B in financial debt. AOL likely came with another €1B / $1.2B in debt ($1.5B purchase price minus $270M in fresh equity). This works out to an enterprise value of €13B ($11.27B post money equity value converted at spot rate, plus the €3B in debt).

Now, 13 billion divided by 1 billion is 13 times. 13 times excluding all the restructuring nasties. Plenty could go wrong considering that 4 out of top 5 businesses were acquired in the last 24 months.

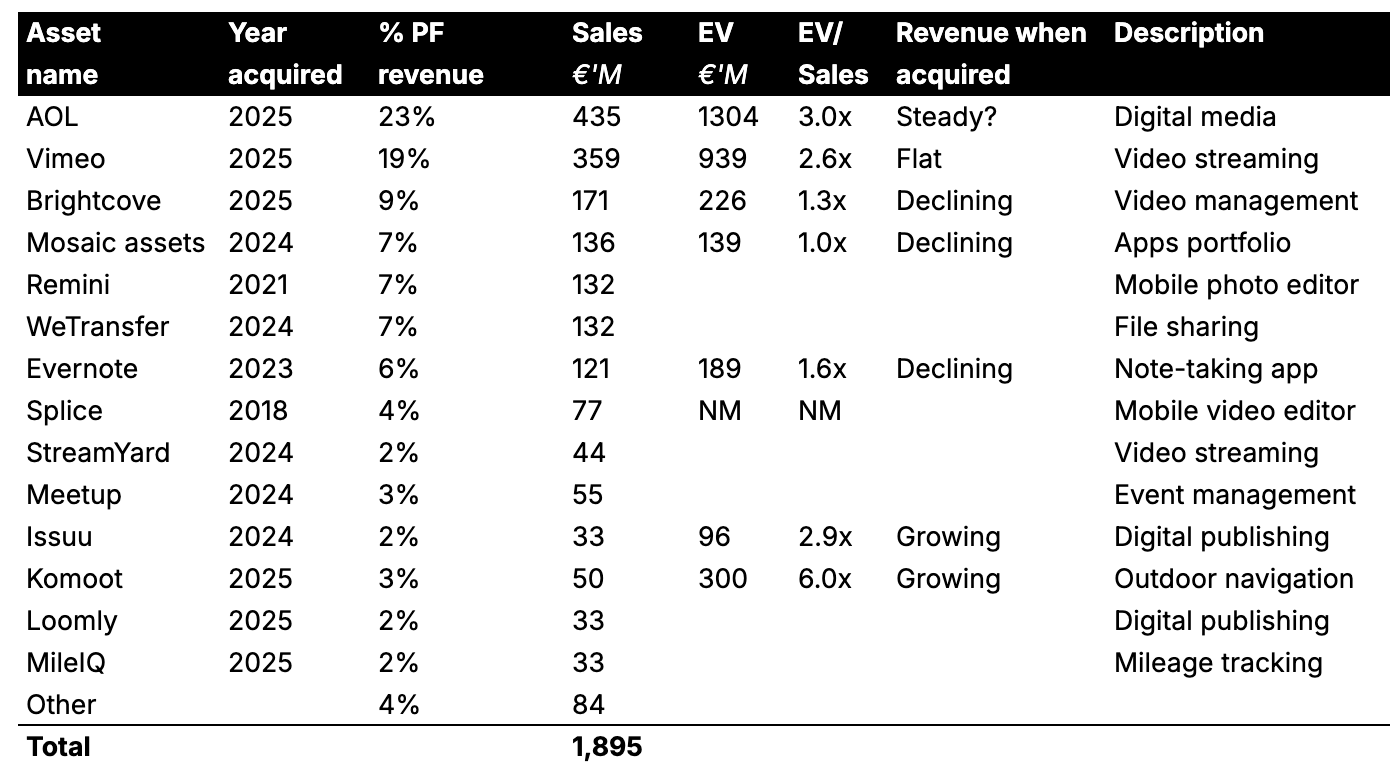

If you’re curious as to how much revenue each product line generate, we've put together an approximate breakdown for you:

Source: S&P, public filings, RollUpEurope analysis

In plain English, Bending Spoons:

Acquires assets for 3-5x adjusted EBITDA (pro forma cost cuts and price increases)

Levers up to 5x EBITDA

Is valued at 13x EBITDA

How’s that for leveraged multiple arbitrage?

Whether or not Bending Spoons can sustain / grow its premium valuation, in our opinion, hinges on two key factors:

Ability to sustain positive organic growth after the initial set of price increases

Ability to generate an acceptable rate of return on a rapidly expanding capital base - while keeping leverage in check

These challenges are familiar to every serial acquirer. One age-old answer is decentralisation. Set up autonomous teams that will hunt for cheap but quality assets requiring as little intervention as possible. Alas, that would be an anathema to the Spoons’ highly centralised business model!

Which leaves the second option: buying ever larger assets with cash flow upside. And that seems to be the direction of travel.

As Luca told Patrick O’Shaughnessy: “we want to do fewer acquisitions, but bigger”. Simultaneously the Spoons are moving their focus away from mobile apps - the domain which they know exceptionally well - to digital media, where their right to win is less clear (the company’s counter is that they have years of expertise working on browser/desktop products - which is fair).

Now, let’s break down Spoons’ playbook using 3 M&A case studies.

2. Acquisition deep dive #1: FiLMiC - how Bending Spoons learnt a lesson about B2B users

Bending Spoons told us that their user base is balanced between B2C and B2B. Its approach to B2B customers has been informed by successes as well as setbacks. In the latter category we would include FiLMiC, a professional video app for smartphones acquired by Bending Spoons in September 2022 for €21.5M (the figure was not publicly disclosed - we found it in an annual report).

Bending Spoons does not spend much on R&D or Sales & Marketing. No need: according to S&P, “user acquisition [...] relying on word of mouth from existing users, and effective marketing spend, leveraging its internal measurement technologies”.

“Internal measurement technologies”. Hmmm what are those? Luckily we didn't have to look far for an answer. A friend forwarded an AlphaSense expert call transcript with a former FiLMiC employee, that explained exactly how that technology works… or doesn't.

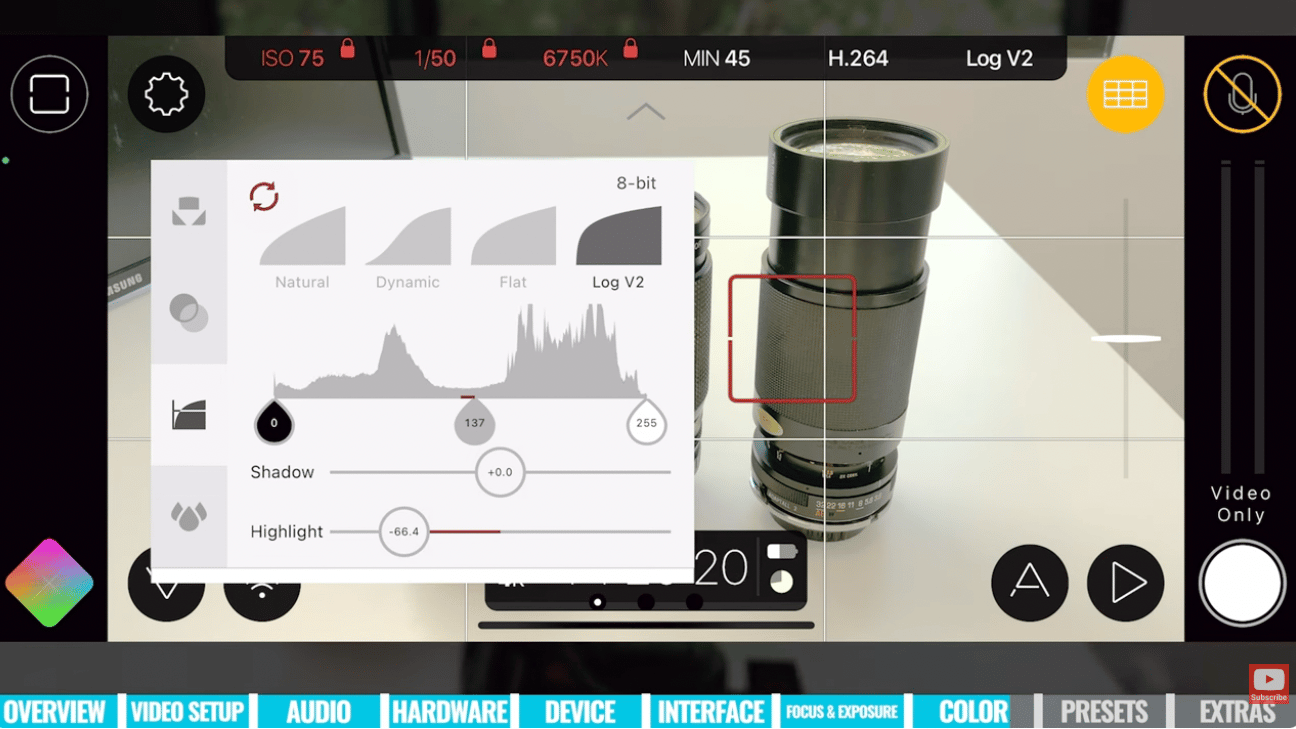

Screenshot from a FiLMiC Youtube tutorial

Bending Spoons has built up formidable expertise in the video editing space, starting with the 2018 acquisition of Splice from GoPro. The purchase consideration was not disclosed. However, we know that the Spoons’ entire M&A spend that year - which consisted of Splice plus 5 fitness apps - totalled €8.7M (source). Today, Splice alone is generating just shy of €80M in revenue!

According to the expert call, Bending Spoons closely tracks user engagement using an internally developed analytics platform. Every product change is A/B tested. Apparently the platform fully integrates with the app. This allows for two intriguing possibilities. One, for a central engineering team to modify the code directly. Two, to develop the product in the absence of customer input. Sidenote: this isn't necessarily representative of the broader strategy. Bending Spoons told us that the recent komoot redesign was based on 110 in-person interviews and 3,000+ online surveys. More on komoot later.

And that, apparently, precipitated FiLMiC’s Bending Spoons’ decision to fire the remaining staff and take the product in-house in late 2023 (source).

According to the expert, this happened:

FiLMiC’s ICP was the “small, but powerful community of filmmakers”. The community didn't take to the Bending Spoons introduced changes, the most consequential of which was the shift from one-off (“lifetime”) payments to weekly subscriptions. Bending Spoons told us that c.10% of their revenue comes from weekly subscriptions. You can decide for yourself whether this number is too much, too little - or just right.

FiLMiC’s lifetime users can continue to access the product without having to upgrade, but only the legacy version that has not been updated since August 2022.

What worked for Splice’s amateur user base did not for FiLMiC’s small but vocal community of power users. They packed up and left. One user neatly summed it up:

“The pricing structure is a bit… confusing, to say the least. But ultimately, considering we used to pay about $20 for the app, a weekly fee of $2.99 (or $0.99? …or even $4.99?) is significantly more expensive, especially when we’re paying for something we might not even need on a regular basis, but only for a few occasions a year”.

FiLMiC isn’t dead. It’s just not doing too well. According to Sensor Tower, its revenue has been in steady decline:

Source: SensorTower

3. Acquisition deep dive #2: komoot - the case for paying 6x sales

komoot, the German routing app with the lowercase “k” beloved by hikers, runners and cyclists, was acquired by Bending Spoons in March 2025. According to press reports, within 10 days, all 6 founders were gone (source). Apparently so were 85% of the 150+ strong workforce (source). The quick process was nevertheless the outcome of a 5-year long courtship.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Access to premium content

- Cancel anytime

- Help keep the lights on 😜