- RollUpEurope

- Posts

- Private Equity professionals are leaving in droves to set up “Independent Sponsors”. What are these - and should you start one?

Private Equity professionals are leaving in droves to set up “Independent Sponsors”. What are these - and should you start one?

Bonus: Indy Sponsor platform tear-down! An insurance brokerage rollup in Italy 🇮🇹 (started by a German and an Australian based out of Zurich)

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

“Large-cap Private Equity doesn't suit me any more” - a sentiment we’re hearing more and more from our readers.

We get it!

The industry’s prestige and financial riches must increasingly be balanced against creeping politics, organisational complacency and a dearth of exits. Partner promotion? Forget it.

In response, the “PE officer corps” - those one or two rungs below Partner - are leaving in droves to set up “Independent Sponsors”. The trend has grown so pronounced that last month we travelled to Munich for the Independent Sponsor Forum to learn about the industry. We must confess that, before the Forum, we had only a fleeting grasp of the concept. Are Indy Sponsors really souped-up search funds? And what makes a Sponsor “Independent”?

Here are our learnings - grouped in 5 chapters:

Warm-up: What are Indy Sponsors - and how do they differ from Search Funds?

Why do Indy Sponsor Fund-of-Funds even exist?

Indy Sponsor economics

The type of people who get funded by Independent Sponsor fund-of-funds

Indy Sponsor deal tear-down: Brera Partners / GBSAPRI - an Italian insurance brokerage Buy & Build

In addition to the conversations at the Forum, in researching for this article we heavily drew on two excellent industry surveys. One by Addleshaw Goddard (AG), a European law firm that is very active in this space (and one of the Forum organisers) and the other by McGuire Woods (MGW), its US counterpart whose Deal Survey is de rigueur in the Indy Sponsor community.

This article is sponsored by PPH Financial, led by the industry’s best Fractional CFO (and our former colleague 💪) Pavleta Pavlova. PPHF specialises in building the financial backbone for serial acquirers scaling from pre-revenue to 9 figures and beyond. Get in touch today on [email protected]

Pavleta Pavlova, the founder of PPH Financial

1. Warm-up: What are Indy Sponsors? And how do they differ from Search Funds?

Independent Sponsors are individuals or teams that raise capital in a PE-style structure (“1 and 10”, “2 and 20” etc.). Also known as “fundless” sponsors, they operate on a deal-by-deal basis - as opposed to investing out of a blind pool.

Since many of our readers are debating which ETA path to take, let’s begin with a comparison of the two most popular structures: Indy Sponsors and Search Funds.

For starters, Indy Sponsors target larger deals. According to the MGW survey, c.60% of US Indy Sponsor deals involve targets with an enterprise value between $10M and $50M. In Europe, according to AG, the median deal size is larger due to c.40% of completed deals being in the €100M+ range. Compare this to the median search fund acquisition of $12M internationally (source) and $14M in the US / Canada (source).

Secondly, the incentive equity formula differs significantly. Indy Sponsors are entitled to performance-driven carry not unlike traditional PE funds: 10-20% carry above the hurdle rate, usually with a catch-up. Searchers earn staged, time- and performance-vested equity: 25-30% of total proceeds.

Thirdly, Indy Sponsors consider themselves as investors rather than operators, while Searchers are expected to run the company(-ies) they've acquired.

Fourthly, and lastly, Indy Sponsors tend to hail from the ranks of seasoned PE professionals, advisors, and industry professionals - whereas the Search Fund crowd is arguably more diverse. The Search Fund model’s biggest flaw may be its need for universality. How many people do you know who are equally good at deal sourcing, DD, operating, and exiting?

Further reading: Side-By-Side Comparison of Key Independent Sponsor and Searcher Terms, by Moore & VanAllen

2. Why do Indy Sponsor Fund-of-Funds even exist?

I have not met a RollUpEurope reader who doesn't want to raise from a Family Office. Or a high-net worth. Or a Sovereign Wealth Fund.

Alas, very few succeed in this endeavour.

The problem is, these types of investors don't necessarily have the patience or the skill to sift through hundreds of pitch decks. Especially from first-time serial acquirers. Funds-of-funds, on the other hand, are happy to work the conference circuit, carefully nurturing relationships with promising managers.

Throw in the benefits of diversification, agency (manager selection is outsourced to someone else), and of course returns (a typical fund targets 3x net MOIC… much higher for top-tier managers) - and you understand why FoFs are proliferating at such a brisk pace.

In the US, it’s names like Ocean Avenue and Align Collaborate. In Europe, Opera and Clearsight (both based out of Zurich), Maxus (Ghent), Yana (Vienna), and of course Headway Capital Partners, Keyhaven and Moore Capital (London).

Based on the AG survey, the most common number of equity investors is one. Indy Sponsor deals tend to be less highly levered than PE transactions, with an initial debt/equity ratio of 1:1.

3. Independent Sponsor economics

Indy Sponsor economics consist of 3 building blocks:

Closing fee

Management fee

Carried interest

Building block #1: Closing fee…

…also known as the arrangement or diligence fee, it is meant to compensate the Sponsor for the work involved in putting the deal together. Not just the time and the travel costs. In Europe, 57% of those surveyed reported being on the hook for all sunk costs. Yikes!

As one UK based Indy Sponsor told me: “You have to be careful with the closing fee to avoid being deemed by the FCA to perform a regulated activity”.

In the US, the picture is more nuanced. According to McGuire Woods: “Institutional investors often provide expense reimbursement to independent sponsors… [who] are less likely to receive broken deal coverage when there is no lead investor or when the lead investor is a family office”.

Back to Europe. Among the respondents with a closing fee (2/3 of total), more than half indicated that the fee was calculated on the basis of invested capital: typically 1-1.5%. A lucky minority (27%) got paid on the basis of enterprise value (same 1-1.5%). This isn’t disposable income. In a majority of cases, the Sponsor commitment is equal to or exceeds the closing fee. Specifically, the most common Sponsor commitment is 5%+ of invested capital. In other words, if you’re raising an equity check of €30M, prepare to put up €1.5M.

In the US, the market standard is to roll over 100% of diligence fees.

Building block #2: Management fee

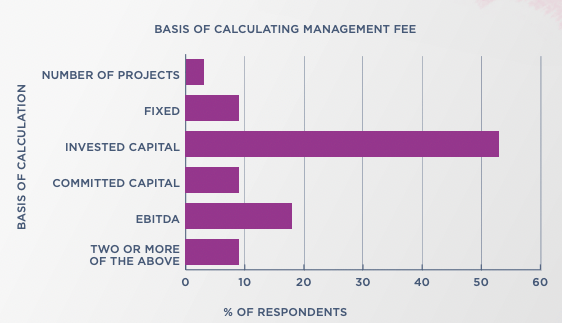

90% of AG’s sample reported having one, most commonly set at 1% or less of invested capital. In a minority of cases, management fees are calculated based on platform EBITDA. The typical range is 3-5%, with an absolute floor and a cap.

Very different compared to the US market - where 75% of the deals have an EBITDA-linked management fee (5% of TTM EBITDA is the default option).

In both markets though the management fee is charged to the portfolio company and not the investors.

Source: Addleshaw Goddard

Building block #3: Carried interest

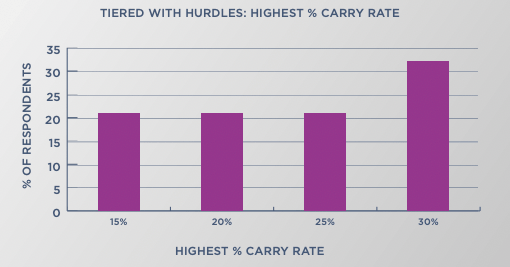

Finally, let’s talk about carry. 50% of the European sample had “tiered” carry with hurdle rates (with Sponsor equity escalating subject to MOIC and/or IRR hurdles being met). More than 40% of all deals had fixed carry. The lowest carry percentage is 10% and the highest is 30%:

Source: Addleshaw Goddard

As one FoF told me, “the common carry range is 10-20% and the market clears at 15%”. An Independent Sponsor added, “In the deals I’ve done, there’s full catch-up up to 20% but not above”.

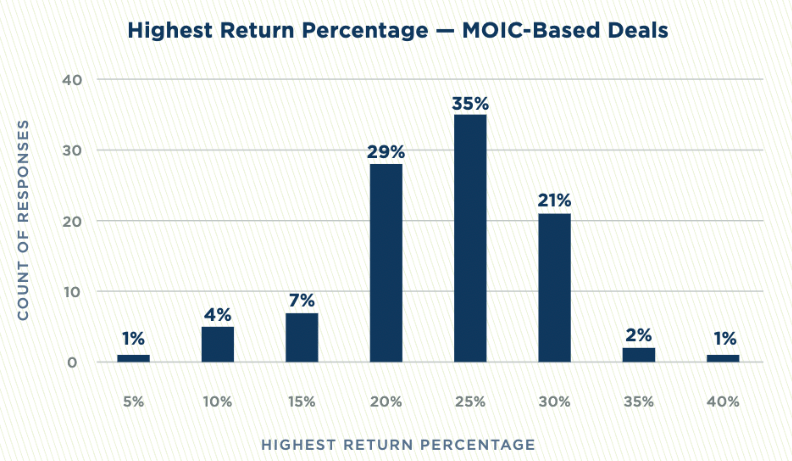

Similar distribution in the US:

Source: McGuire Woods

4. The type of people who get funded by Indy Sponsor fund-of-funds

Now, given the abundance of capital and with a focus on smaller, less competitive deals, aren’t Indy Sponsors just “PE on easy mode”?

Absolutely not!

Firstly, certainly in Europe, few people will even qualify to be backed by an Independent Sponsor fund-of-funds. With the influx of capital, the bar has risen.

Judging by the people we met at the conference, the typical first-time Indy Sponsor is a mid-career PE professional with +/- 15 years of directly relevant domain expertise. Don’t have that? Don’t bother.

Secondly, no-one is keen to pay high multiples… but everyone is keen to write bigger checks! Headway’s latest fund is at €627M (c.$780M). That’s almost double its predecessor fund. Headway thus prefers to write €20M+ checks per platform. In Europe that’s already lower mid-market PE territory!

Exhibit A - Brera Partners: an independent sponsor based in Zurich and backed by Headway. Brera was founded in 2021 by Tin Radosevic and Andrew Borda: two ex PE folks in their early 40s, with pedigree. Tin is a former Managing Director at Preservation Capital Partners, a mid market Sponsor out of the UK focused on asset-light financial services (wealth management, insurance broking etc.). Andrew is the former CEO of Greenoaks Global Holdings, or GGH, a PE backed rollup of emerging markets insurers.

Tin and Andrew succeeded because they stuck to the knitting. Tin described Brera’s investment strategy as “asset-light financial services … everything apart from traditional banks and traditional insurers. Recurring revenue, lower regulation, high margins, high cash conversions”.

Next, let’s review the terms of Headway’s investment into Brera, and what Brera did with the money.

5. Indy Sponsor deal tear-down: Brera Partners / GBSAPRI - an Italian insurance brokerage Buy & Build

In April 2024, Brera acquired GBSAPRI Group - a Rome based insurance broker with 9 offices across Italy. It paid €16M for a 61% stake in an asset generating €5M in EBITDA. Eurazeo provided a €26M unitranche facility.

The founder and CEO Giuilio Spagnoli chose to stay, transitioning to a Chairman role. Giulio’s deputy GBSAPRI Carlo Maria Bassi (pictured below) was promoted to the CEO. Carlo has an 11% stake in the BidCo (Appia Holding Spa) and Giuilio, 10%.

Carlo Maria Bassi. Still from a promotional video

The initial business plan contemplated adding 2-3 businesses per year, each bringing <€1M EBITDA. The team promptly got to work, swallowing smaller competitors like Convergo, Seabridge (specialising in marine cargo, credit insurance, and fine arts, €3M revenue) and Ernesto Solari Assicurazioni (nautical specialist, €13M revenue).