- RollUpEurope

- Posts

- Rollups from Hell Vol.4. Embracer: keeping game face on after 160+ acquisitions, a three-way split, and a 90%+ share price drop

Rollups from Hell Vol.4. Embracer: keeping game face on after 160+ acquisitions, a three-way split, and a 90%+ share price drop

Lars Wingefors’ journey: flogging second-hand comics -> rollup billionaire -> a gaming industry’s bête noire

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

Raise your hand if you’re familiar with Embracer Group: formerly the world’s most prolific gaming rollup. Even if the name doesn't ring a bell, very likely you've interacted with an Embracer product. Video games like Sin City and Tomb Raider. The board game Catan. Or perhaps you have Lord of the Rings merch hanging in your closet?

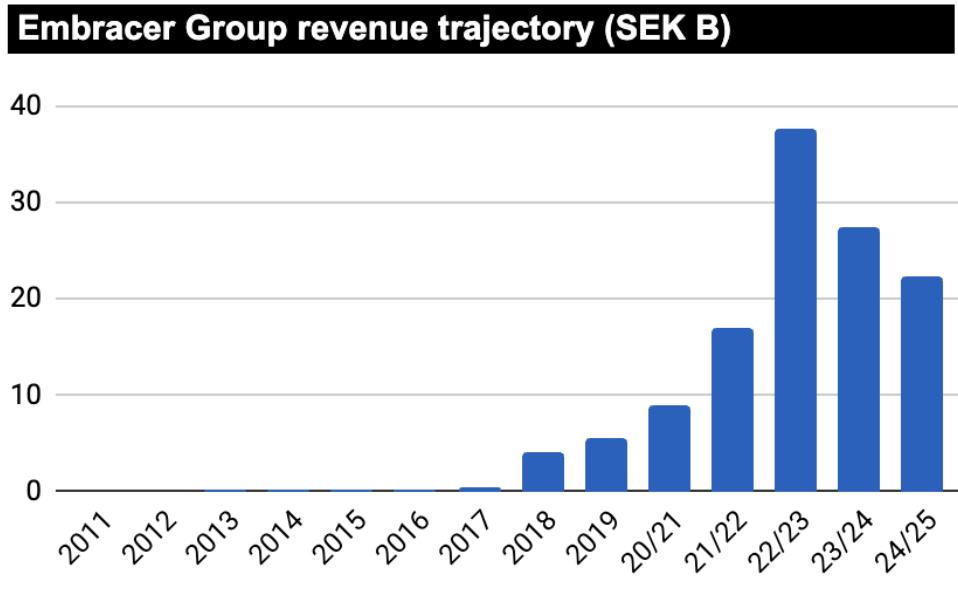

Embracer was founded 15 years ago by the Swedish entrepreneur Lars Wingfors. It was a rollup from Day 1. Two well-timed franchise acquisitions from insolvent publishers - JoWooD in 2011 and THQ in 2013, whose name it briefly adopted - propelled revenue from 0 to over SEK 300M (~$30M. Note: based on spot fx).

This was just the beginning. By 2020, the newly rebranded Embracer had surged to SEK 5B (~$545M) in revenue, with acquisitions of titles Saints Row and Dead Island.

And then it switched on turbogrowth.

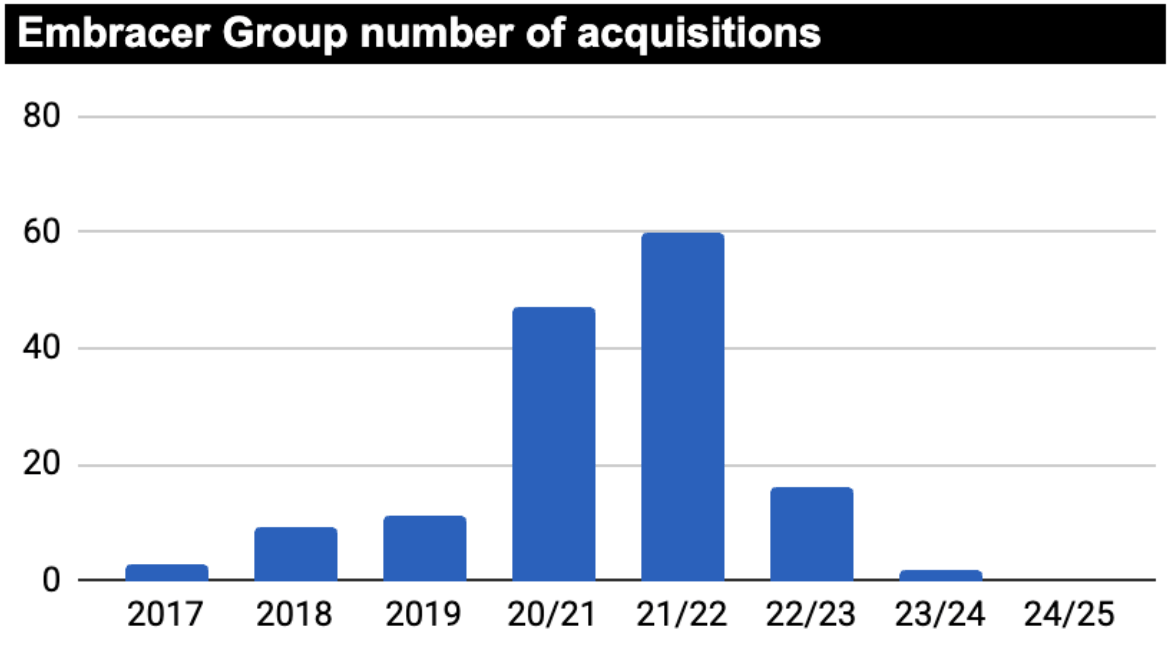

During Covid, which coincided with the financial years 2020/21 and 2021/22, Embracer closed 100+ acquisitions. Revenues grew 8-fold, from SEK 5B to SEK 40B (~$4.3B) on a run-rate basis. Since the accompanying spend of SEK 44B (~$4.8B) dwarfed the cumulative operating cash flow of only SEK 8B (~$860M), Embracer borrowed profusely, as well as issuing new stock and earnout IOUs.

Source: public filings, RollUpEurope analysis

Embracer pursued no integration. Duplications proliferated, exacerbating the industry’s longstanding cost pressures (more on that later). Worse, Embracer’s arcane reporting made it all but impossible to understand how the underlying businesses were really performing - in terms of growth or cash flow generation.

Sounds familiar? Bet it does! There are more than a few similarities between Embracer and Storskogen - the other Swedish “rollup from hell”, which we covered here.

Unlike Storskogen though, whose public market honeymoon was very short-lived, at first Embracer’s shareholders had little to complain about. The shares hit a record high in the spring of 2021 giving it a market cap of $13B. IPO investors were sitting on a 40x+ windfall.

And then, as the world reopened after Covid and the gamers’ ranks dwindled, Embracer’s towering debt pile came into focus. The company responded by selling assets and splitting the rump three ways.

Objectively, today Embracer is in far better shape than 2 years ago. On the one hand, revenues are 60% lower due to spin-offs of the tabletop (Asmodee) and indie/mobile game (Coffee Stain) divisions; and countless disposals. But on the other hand, it’s still pumping out an EBIT north of SEK 2B (~$220M): 20x more compared to 2016, when it went public. And yet, Embracer’s share price is only 2.5x the IPO levels and not going anywhere fast.

More pain on the way? Bear in mind this is a top 10 shorted stock on the Swedish market, with 8% of the issued share capital (10% of the free float) on loan.

Source: Google Finance

Why is that - and what can we learn from Embracer’s rollercoaster ride?

Read on to learn about:

Lars Wingfors’ journey from flogging second-hand comics to a gaming billionaire

Embracer’s controversial M&A playbook

The problem with Asmodee - Embracer’s largest acquisition and a standout French rollup success story

The gist of Embracer’s beef with the short sellers - and why the stock remains in the penalty box

Learnings for serial acquirers.

Note: Dima Kovalchak meaningfully contributed to this article. All views expressed in it are his own. Dima has a wealth of M&A and Strategy experience across the interactive entertainment and technology sectors, and is currently a senior member of the Strategy team at Aristocrat (ASX: ALL).

Dima Kovalchak

1. Lars Wingfors’ journey from flogging second-hand comics to a gaming billionaire

Lars Wingefors is a self-made man. According to a 2022 profile, “while studying at a secondary school in Sweden, he started selling second-hand comics and by 18 he had dropped out of sixth form to focus on his fledgling mail-order business.”

Age 23, Wingefors became a paper millionaire after exiting the business to the British dotcom startup Gameplay.com. Unfortunately, a year later, Gameplay ran into difficulty and its stock became worthless.

Lars Wingefors. Credit: Sveriges Radio

Undeterred, Lars bought back the business for £1, rebranding it to Game Outlet Europe. 3 years later, he branched out into publishing with Nordic Games Limited (NGL). Notwithstanding several breakout successes that were developed in-house (e.g. the We Sing franchise on Nintendo Wii), NGL Nordic Games found better value in buying existing content - from motivated sellers.

One such transaction was the 2013 asset deal involving the fallen US gaming giant THQ. THQ’s business had been laid low by the Great Recession. After failing to repay a bank loan in 2012, the company entered Chapter 11. Some of its assets were snapped up by the Austrian Koch Media, which utimately was absorbed into Embracer in 2018. Included in NGL’s transaction perimeter was the THQ brand as well as franchises like Titan Quest and Darksiders.

Purchase price? ~$5M.

More deals followed. Quickly, Lars earned the reputation of a distressed buyer “that brought forgotten titles back to life”, in the words of a gaming industry blogger. It was time to go big:

Source: public filings, RollUpEurope analysis

There was one problem: