- RollUpEurope

- Posts

- The Rollup of Tomorrow Vol 10. Kaspar Companies: Guns, Saddles & Bullion - a uniquely resilient 127-year old Texas HoldCo

The Rollup of Tomorrow Vol 10. Kaspar Companies: Guns, Saddles & Bullion - a uniquely resilient 127-year old Texas HoldCo

Jason Kaspar took over family HoldCo after a successful Wall St career. His views on capital allocation, the AI opportunity - and more

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

Welcome to Episode 10 of our interview series.

Jason Kaspar is the fifth-generation CEO of Kaspar Companies, a 127-year-old family HoldCo based in Shiner, Texas. With 400 employees, Kaspar Companies owns a portfolio that is quintessentially Texan. A saddle manufacturer. A precious metals trading business. A heavy-duty truck bed manufacturer. A firearm manufacturer. And then some.

Kaspar Companies is a rare breed: a multi-generation family business that has survived 20 recessions, two world wars, and countless economic cycles.

I met Jason at the Capital Camp conference a few months ago (read my writeup here), where we bonded over shared beliefs in capital allocation and long-terminism. Upon my return to Europe, I caught up with Jason to learn about the principles that underpin Kaspar Companies.

Jason Kaspar

On the interview, Jason walked me through:

The origins of Kaspar Companies

Jason’s key metrics when buying - and running businesses

The SKILLS system and Jason’s approach to capital allocation

The philosophical origins of Texas Precious Metals

Jason’s AI playbook - and the results so far

The future: stay private vs. go public

If you like the article, make sure to check out the Spotify pod for the extended version of the interview!

1. The origins of Kaspar Companies

Alex: Welcome Jason! Kaspar Companies owns businesses that I can only describe as quintessentially Texan - a saddle manufacturer, a gold and silver trading business, heavy-duty truck beds, and a bolt-action rifle firearms business. How did all these businesses emerge and what is the story of the Kaspar family?

Jason: My great-great-great grandfather came over from Switzerland. He was a Lutheran missionary in the mid-1800s. He arrived in the port of Galveston and settled in central Texas when there were still range wars and Indian raids.

His son was a farmer. When barbed wire came to Texas, smooth wire became scrap - big piles of wire behind various barns. He was a tinkerer, an inventor. He would take this wire scrap and start making corn husk baskets and horse muzzles. A neighbor said, "I'll give you a dollar for it." Starting around 1894-1895, he loaded up wagons and went around selling these wire products.

In 1898 he incorporated Kaspar Wireworks. The company evolved over the decades. We did stuff for the war effort during World War I and World War II, even when there were steel and wire shortages.

Kaspar Companies really became much bigger in the 1950s when we acquired a patent for a vending machine - newspaper racks. 90% of them in North America came out of our factory in Shiner, Texas. But that eventually went the way of the dodo bird as the Internet came to be.

From that, we continually reinvented ourselves. We have four platforms now - some we've acquired, some we started from scratch seeing innovative opportunities.

Source: Kaspar Companies website

A lot of people ask, "How do those all work together? They seem disparate." But at least in Texas or Americana - if you own a truck, you might own a horse. If you own a horse, you probably own a gun. If you own a gun, you're probably interested in gold and silver and real assets.

The saddle manufacturer we bought after a tragic plane crash when the owner passed away a few years ago. It was in our area and we felt like we understood the customer - that western lifestyle.

The Bedrock truck bed business started out of another company we owned.

Source: Kaspar Companies website

Truck beds haven't really innovated much over the decades. One problem is that you have a headache rack and you have a Ford model, GM model, Chevy model - you have to create all these SKUs. Distributors have to hold massive inventory. We patented an adjustable headache rack that became a large business in our portfolio.

The bolt-action rifle company is one we acquired. Texas Precious Metals is a company we started from scratch. We have about 400 employees, all located in Texas.

2. Jason’s key metrics when buying - and running businesses

Alex: Given the diversity of businesses in your portfolio, are there unified metrics you look at when you evaluate performance? And similarly, when you look for acquisitions, what are the main KPIs?

Jason: We adopted the Toyota Production System, also known as the Lean System. On the acquisition side, we really look for companies that have been managed suboptimally from a working capital perspective. Can we take working capital out of the business to almost fund the acquisition itself?

Some of those platforms have themselves become holding companies. For example, we bought a bolt-action rifle company and then another one called Stiller which makes actions. They had massive amounts of inventory. We were basically able to finance the entire acquisition by streamlining and overlaying our business systems through working capital reduction.

The other thing is: can we improve revenue per FTE? It's one of my most important metrics that I talk about to all of our presidents and subsidiary leadership. Productivity equals wealth over the long term.

And lastly, do we have insight to the end customer that can drive value.

Internally, we focus on revenue per FTE as well as ROIC. Every month we get a report from each subsidiary that analyzes both these metrics.

3. The SKILLS system and Jason’s approach to capital allocation

Alex: You mentioned the Toyota Production System and Danaher. How did you go about implementing this across such diverse businesses?

Jason: We developed our own business system called SKILLS - Safety, Kaizen, Investing, Lean Daily Management, Leadership, and Strategy Deployment. Each module is an ever-growing system, like Danaher's, that we've been refining over seven years.

The way we do strategy - the cadence, the learnings, the visual tools - they all overlap whether you're in rifles, precious metals, or saddles. We use the Hoshin Kanri matrix for strategic deployment. We bring all subsidiary presidents together quarterly to share the learnings.

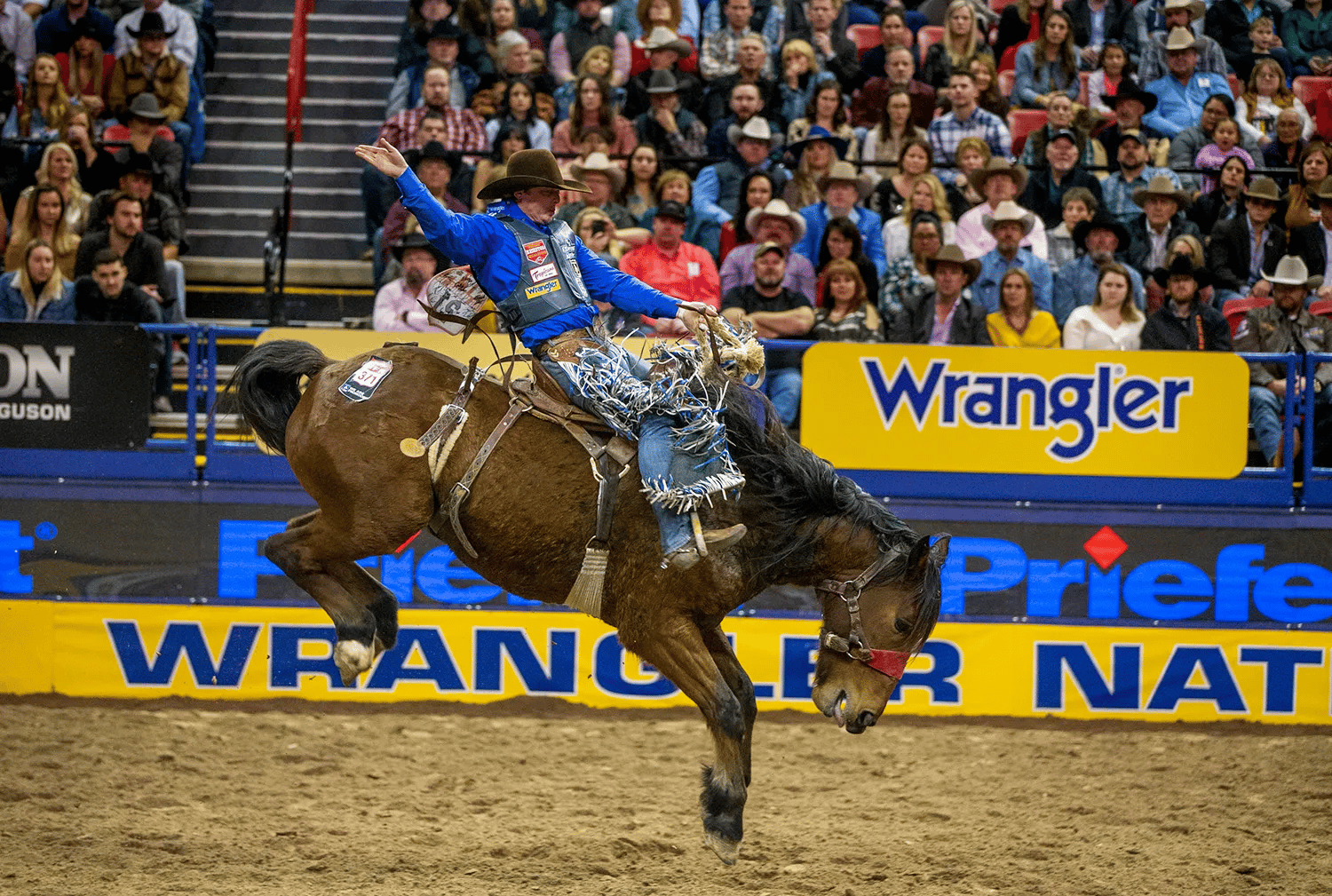

A specific example: every November, all our companies attend the National Finals Rodeo in Las Vegas. It’s the Super Bowl of rodeo. It's the largest consumer-to-business show Vegas puts on. Rather than having four separate booths, we pooled our resources to create an outsized presence with a unified story about the U.S. Western lifestyle.

National Finals Rodeo. Source: Reviewjournal.com

Another example: capital acquisition requests, or CARs. The CAR committee has people from each subsidiary. If the truck bed company wants a $1.2M expansion, Texas Precious Metals and our gun company review it and provide input before it goes to the board.

That's how the ecosystem works together. And when we look at bolt-on acquisitions, we evaluate how we can overlay our Kaspar Business Systems

Alex: Let's talk about capital allocation. You mentioned the cult of ROIC. Every dollar of cash flow is scrutinized. How do you decide between reinvesting in the business, buying another business, or dividending it out to shareholders?