- RollUpEurope

- Posts

- These family problems aren't going away! What can we learn from the decade-long PE adventure of Stowe Family Law?

These family problems aren't going away! What can we learn from the decade-long PE adventure of Stowe Family Law?

Under Livingbridge's ownership, Stowe grew 5x to become the UK’s dominant family law practice. How come the Sponsor didn't make a killing then?

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

Every time I open Linkedin, the first thing I see is people commenting on law firm M&A.

Mega-mergers like Hogan Lovells / Cadwalader and Perkins Coie / Ashurst are the flavour of the day. In the US, Private Equity has joined the party with gusto, leveraging ownership rule loopholes like Management Services Organizations (MSOs) and Alternative Business Structure (ABS). And don't forget about the newcomers! In September 2025, the “legaltech” Lawhive acquired the British high street law firm Woodstock.

The premise of injecting technology and PE money into law firms to turbocharge growth and profits is both tantalizing - and distinctly unoriginal.

Huge TAMs are at stake: $400B+ in the US (source) and $70B+ (£52.4B) in the UK. The UK is the spiritual home of law firm buyouts thanks to the Legal Services Act 2007 aka the “Tesco Law”. The Act created Alternative Business Structures, allowing “for non-lawyers to be involved in the management and ownership of businesses that provide legal services” (source).

The first UK ABS license was issued in 2012, triggering a PE gold rush. According to Acquira, a specialist M&A advisory firm, “there is an emerging pattern of private equity investors targeting certain types of legal businesses”. Think Fletcher - a personal injury and medical negligence specialist acquired by Sun European Partners in 2021 or Beyond Law - a federation of specialist legal practices (Beyond Corporate, McAlister Family Law and Home Property Law) acquired by Waterland in 2024.

It’s too early to tell how these transactions are going to pan out.

After all, law firms are very different to accountancies, PE’s other professional services obsession. Revenues are lumpier. There’s a key man risk. The flipside is the market fragmentation and the counter-cyclical nature of niches like personal injury and wills.

Still, one platform provides insight into what works and what doesn't over the long term. Meet Stowe Family Law - the UK’s No.1 specialist family law practice that has been continuously owned by PE for close to a decade. First by the mid-market firm Livingbridge (2017-24) and for the last 1.5 years by Investcorp.

Stowe Family Law Altrincham team. Source: company website

In the meantime the family law market, worth some £2.2B ($3B) has fundamentally changed.

The introduction of Divorce, Dissolution and Separation Act in April 2022 made the administrative act of ending a marriage easier. Digital divorce applications and fixed-fee legal packages are now common, with law firms chasing the lucrative ancillary business of dividing assets and custody. As a result, the number of family law firms dropped by 20% between 2018 and 2025 (from 5,700 to 4,700 - source 1, source 2). This, however, benefited digitally savvy operators like Stowe who were able to profitably execute low-margin but high-volume work.

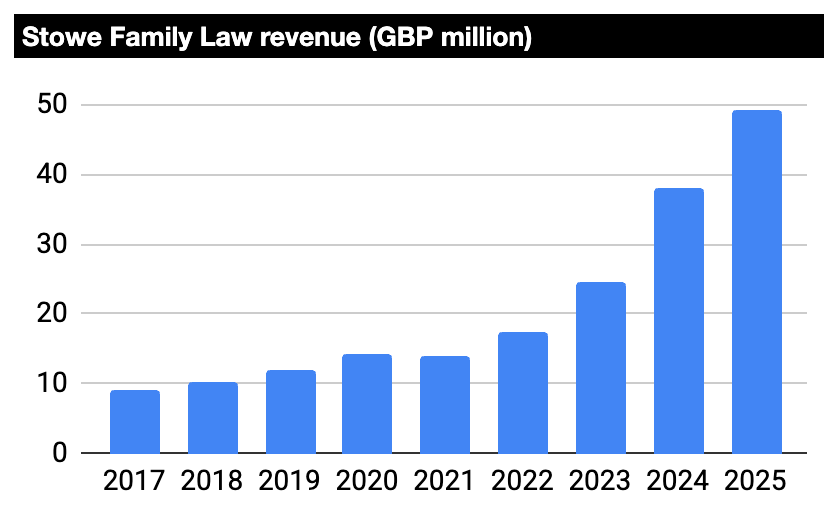

All told, between 2017 and 2025, Stowe grew revenue from £9M (c.$11M) to £49M (c.$63M), a CAGR of 24%, outpacing the overall market by a factor of 4:

Source: UK Companies House. Note: YE March

With so much M&A activity involving professional services firms, the Stowe case study should be high up on the reading list of PE investors and “AI rollups” alike. Here are 3 reasons why:

Firstly, unlike traditional buy & builds, Stowe grew mostly organically. By opening new offices and entering new niches - and not so much M&A.

Secondly, as a B2C business, Stowe nailed the SEO playbook. In just 3 years, it doubled the number of inbound customer enquiries, from 26,000 to 65,000. Unusually for a firm a) owned by Private Equity that b) deals in delicate matters like divorce and inheritance, Stowe is actually highly rated by its customers (TrustPilot, ReviewSolicitors.co.uk).

Thirdly, and lastly, contrary to what you might expect, Livingbridge’s investment returns were OK, not spectacular. Outside-in, we estimate a gross MOIC of sub 3x and an equivalent IRR of 15%.

Read on to learn about:

The horrifying - and inspiring back story of Stowe Family Law

How Livingbridge structured the original buy-in and tackled management exodus

Stowe’s 5-part playbook for growing revenue from £9M to £49M

Livingbridge’s 2024 exit to Investcorp & lessons learnt

***

1. The horrifying - and inspiring back story of Stowe Family Law

Marilyn Stowe - nickname “Barracuda” - founded Stowe Family Law in Leeds in 1982. Stowe had been an under-the-radar, provincial firm for the first 20 years of its existence. Then, in 2002-03 two major events reshaped its destiny.

Firstly, in 2002 Marilyn gained national prominence by helping exonerate Sally Clark, a fellow solicitor who had been wrongfully accused of murdering her two infant sons. Marilyn, who represented Sally on a pro bono basis, won the case after meticulously reviewing reams of medical records - this is two decades before ChatGPT by the way (source) - and in the process discrediting the testimony provided by the paediatrician expert witness. The paediatrician, Sir Samuel Roy Meadow, was eventually struck off from the British Medical Register.

The good times didn't last though.

In December 2003, just months after the Clark exoneration, Marilyn was assaulted in a car park close to her offices by three masked men. Marilyn’s recollection of the accident was this: “One had an iron bar and I just can’t forget it, he kept shouting to the other two ‘kick her head in’”. Marilyn survived after the passers-by spooked the assailants, but was “unable to walk properly for a while, was badly bruised and suffered from severe mental trauma after the attack”.

Marilyn Stowe

Marilyn responded by relocating the business from Leeds to the spa town of Harrogate, half an hour drive north. Incredibly, there was a silver lining! As Marilyn put it in another interview, after the move the business “really started to fly”. By the time Livingbridge rocked up in 2017, Stowe had grown from 1 office to 10, with 30 solicitors (source).

2. How Livingbridge structured the original buy-in and tackled management exodus

In February 2017, Livingbridge acquired Stowe for £27M (including £2M in transaction costs), or roughly 9x trailing 12 month EBITDA. According to public filings, the purchase was funded with a £25M in shareholder loan carrying a PIK interest of 8%, stepping up by 1% each year until September 2023 when it became due, repayable in four equal, semiannual instalments.

Filed in late 2017, Stowe’s first confirmation statement under PE ownership shows that roughly 20% of common equity was allocated to the management, with 5 individuals holding between 3% and 5% each:

Charles Hartwell - CEO

Benjamin Stowe - a lawyer and the son of the firm’s founder

Julian Hawkhead - a Senior Partner at the firm

Darryn Hedges - CFO

Stephen Ross - Chairman

A bizarre move from Livingbridge to put an all-male leadership in charge of a firm that historically was 70% female. Not that Marilyn was around to object. She was out after a 2-week transition period, followed by a 3-year non-compete (source).

Within two years, 3 of the 5 men (Benjamin, Darryn and Stephen) were gone as well. The CEO joined the exodus in early 2020, apparently to start a competitor… but ended up leading a provider of outsourced veterinary controls that was snapped up by Phenna for £32M (c.$41M) in December 2023.

What happened? According to an FT article that quoted unnamed former employees, “rapid hiring and expansion at Stowe created a lack of continuity for clients. Employee churn on cases had led to an increase in miscommunication and mistakes”.

Livingbridge rebuilt by hiring a new Chairman (Ken Fowlie, former CEO of Slater & Gordon - the first law firm ever to go public), and promoting Morna Bunce from Head of HR and Facilities to Chief People Officer and Victoria Burns from Head of Marketing to Chief Commercial Officer.

Management equity remained at 20% of the common. What were the terms?

The grants were subject to 2-year vesting schedules, with 6-month increments and standard Good / Bad / Very Bad Leaver provisions.

Under the terms, a Very Bad Leaver had to part with their shares for just £1. A Bad Leaver was entitled to the lesser of the Issue Price and Market Value. The Good Leaver provision, however, followed this formula:

Leaving date | Sale price |

Before the first anniversary of the Acquisition Date | The lower of the Issue Price and Market Value |

On or after the first anniversary, but before the second anniversary | 75% at the lower of Issue Price/Market Value and 25% at Market Value |

On or after the second anniversary, but before the third anniversary | 50% at the lower of Issue Price/Market Value and 50% at Market Value |

On or after the third anniversary, but before the fourth anniversary | 25% at the lower of Issue Price/Market Value and 75% at Market Value |

On or after the fourth anniversary of the Acquisition Date | Market Value |

…that is, other than for instances such as death and disablement. In which case share sale would go ahead at Market Value.

The distribution waterfall was straightforward: surplus assets distributed amongst the holders of the Equity Shares on a pari passu basis. Knowing this, it becomes clear why Livingbridge felt compelled to reboot the capital stack in the middle of Covid. Specifically, in September 2020, it agreed to waive £14M in loan notes and accrued interest to “protect the future value of ordinary equity in the business”. In return, starting from April 2021, Stowe began to settle a proportion of loan interest in cash.

The Sponsor’s calculation must have been simple. Key personnel owned 20% of common equity but 0% of the loan notes. Faced with the CEO’s departure one month before the lockdown, the expiry of Marilyn’s non-compete, and the Covid hysteria, Livingbridge had to act fast to demonstrate to the remaining management its commitment to Stowe.

3. Stowe’s 5-part playbook for growing revenue from £9M to £49M

First and foremost, grow the network!

Back in 2017, Livingbridge had planned to open 30 offices within 5 years. It actually exceeded the target, with 46 offices by March 2022 (+36). By March 2025, that figure had ballooned to 99:

Source: UK Companies House. Note: YE March

In the digital age, why such emphasis on physical presence?

Let’s hear it from the firm itself: “the clients value the opportunity for face to face interaction with the lawyers, and this validates our strategy of opening modest sized offices throughout the country and close to where our target client base reside or work, rather than having a small number of larger offices with a less personal service offering” (source: Stowe 2019 annual report)

Secondly, Stowe added capabilities where it saw client demand. In 2019 alone, it branched into surrogacy and Inheritance Act dispute work, and tripled the Adoption team size (from 2 lawyers to 6).

Thirdly, selective M&A.