- RollUpEurope

- Posts

- Strange bedfellows or a match made in heaven? VC & “Trad PE” money is pouring into HoldCos: why and on what terms?

Strange bedfellows or a match made in heaven? VC & “Trad PE” money is pouring into HoldCos: why and on what terms?

INSIDE: Deep-dives on Venmark and Raptor - new kids on the block backed by atypical investors. PLUS: How General Catalyst prices AI rollups.

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

2025 truly was The Year of the Rollup Promoter.

We know of one mercurial individual who launched 3 platforms in completely different industries. All 3 got funded by brand-name investors. Makes Steve Witkoff and Marco Rubio look truant by comparison!

We’re not jealous. We’re thankful to these Rollup Promoters for introducing the genre to atypical investors like traditional Private Equity and Venture Capital.

Wait, why atypical? Aren't most rollups backed by institutional investors?

Yes, but… we’re talking about two specific categories here:

De novo HoldCos: decentralised vehicles in the style of Swedish serial acquirers; and

PE-style Buy & Builds that target very significant margin uplift by adopting AI

As our LTH primer explains, Category #1 is well catered for by names like Reef Pass, Hampton River and Pacific Lake. A niche but growing source of capital that ties founder outcomes to investor Multiple of Invested Capital, or MOIC - as opposed to IRR, which arguably disincentivises long-term compounding.

As for Category #2 - essentially starter rollups for mid-market PE - the investor landscape is even broader:

Search fund investors

Independent Sponsor Fund-of-Funds like Yana Partners, Opera and Keyhaven in Europe; and Ocean Avenue in the US

Rollup incubators / accelerators like Strada Partners and Alpera (ex Otium) in Europe; and Alpine Partners in the US

And yes, we've got a primer on Indy Sponsors as well! Their economics are not that different to what you see in a PE fund i.e. 10-20% carry with a management fee linked either to committed capital (Europe) or platform EBITDA (US).

This is where things get muddled.

Looking outside-in, it’s not at all obvious why PE firms whose bread and butter are synergised, tightly defined Buy & Builds are so enamored of software HoldCos:

Platform | Product / geo focus | Yr founded | Anchor investor(s) |

Everfield | VMS / Europe | 2022 | Aquiline |

Big Band | Enterprise / US | 2022 | Parker Gale |

Confirma | Enterprise / Nordic | 2019 | Abry |

Civica | Public sector / Europe | 2001 | Blackstone |

Raptor Collective | VMS / agnostic | 2025 | UK PE firm |

Or why VC firms, whose raison d’etre is Power Law, are suddenly piling into brick and mortar industries like property management, tax advisory, or mature Microsoft apps:

Platform | Industry focus | Yr founded | Anchor investor(s) |

Aries Global | Software / Microsoft | 2024 | Cherry |

Beacon Software | Software and services | 2024 | General Catalyst, Lightspeed, D1 |

Dwelly | Property management | 2022 | General Catalyst, s16vc |

Unaric | Software / Salesforce | 2022 | LocalGlobe, Concentric, FJLabs |

Venmark | Testing, Inspection & Compliance | 2025 | Creandum, Cherry |

In November 2025, General Catalyst, the High Priest of the AI Rollup Hype, led Beacon's $250M round at a $1B pre-money valuation. Note: Beacon is 2 years old.

It’s too early to tell how these “AI HoldCos” will perform over the long term. What we do know is that the bar is HIGH! We have heard that General Catalyst targets 50x MOIC from early stage investments. More on that in Chapter 3.

Detractors will point to the mathematical impossibility of squeezing venture-style returns from mature, slow-growing businesses, especially outside of software.

Who to believe?

We posed this very question to Sahil Patwa, an AI roll-up investor and a longtime friend of RollUpEurope.

Sahil Patwa

Sahil’s take was this:

In many industries, AI-driven transformation can indeed improve margins by 4-5x and unlock 30–50x MOIC. In those cases, AI roll-ups could be compatible with a VC-style fund-returner model. But in other industries, AI may drive much lower (but still meaningful) EBITDA uplifts. This can still generate superior returns to PE and Search Funds, but it might not be compatible with VC fund construction and Power Law requirements. The critical unknown is not ambition or execution, but how powerful AI capabilities will be 4-5 years from now, which no one can credibly predict.

The catch here is that once you take VC capital early on in the journey, you are committing to deliver 30-50x returns and grow into a $billion+ business - or go bust trying. The alternative, traditional PE and search-fund structures, are simply not flexible enough to support the early-stage investments in technology and change management required to drive radical AI transformation.

Instead of force-fitting either VC or search-fund/PE structures onto this new asset class, there is a need for a new, more flexible type of capital that is purpose-built for AI roll-ups at the inception stage.

Thanks Sahil! Dear reader: if you’re looking for a deep-dive on AI rollups, we have not one, but two articles for you to review:

Also, be sure to subscribe to Sahil's Substack.

In this article, we review the terms on which two newcomer acquirers raised money in 2025 - one from PE, one from VC

Read on to learn:

Are Traditional Private Equity and HoldCos strange bedfellows - or a match made in heaven?

Inside Raptor Collective: a challenger VMS HoldCo reportedly backed by PE

A VC backed rollup? That’ll cost you dearly! Valuation and governance insights from Venmark, Aries and Dwelly. BONUS: How General Catalyst prices AI rollups

This article is sponsored by TechCredit Partners: your trusted debt advisor. Guys, it’s 2026: don't DIY debt. Focus on what you’re really good at. And let Linus take care of the debt raise.

1. Are Traditional Private Equity and HoldCos strange bedfellows - or a match made in heaven?

Why even pose this question? Because of the elephant in the room: mismatched investment horizons.

Private Equity holding periods have been relentlessly rising: from 3-4 years before the Global Financial Crisis to about 6 years today. Blame the challenged fundraising environment and scarcity of exit opportunities. But even 6 years might be too short. For most decentralised HoldCos, achieving scale in a sustainable manner takes a long time. Building deal flow and the M&A muscle. Developing best practices around GTM, capital allocation, working capital etc.

Take Valsoft. This 10-year VMS HoldCo is closing in on $800M in revenue. In 2016, Valsoft complete Acquisition #1. In 2017, 2 more deals followed. Today, Valsoft is closing 20+ deals per year. All in all, it took Valsoft 6+ years to get to to add $350M in revenue - but only 3 to add the next $350M.

If you can afford the wait, financial and reputational rewards can be enormous. The Norwegian Visma is one of Europe’s most valuable tech companies and a software aggregator par excellence. Backed by Hg Capital for the last two decades, Visma has been meticulously buying up accounting, tax and payroll apps all over the continent and now in Latin America too (read our deep-dive). 10 years ago, Visma had $1B in sales. Today, it’s almost 4x bigger. And it keeps growing at double digits!

Whether de novo software HoldCos can repeat Visma’s heroic feat in today’s rather unforgiving environment (intense competition for assets, AI disruption etc.) will be proven by the exits of newer PE backed HoldCos like Everfield (Aquiline), Confirma (Abry), Big Band Software (Parker Gale)… and now also Raptor Collective: a newcomer from the UK:

Source: Raptor Collective

Raptor is reportedly backed by a mid-market UK PE firm. We cannot disclose the Sponsor’s name as the information is not public yet - but we do know the terms of their partnership from the filings.

2. Inside Raptor Collective: a challenger VMS HoldCo reportedly backed by PE

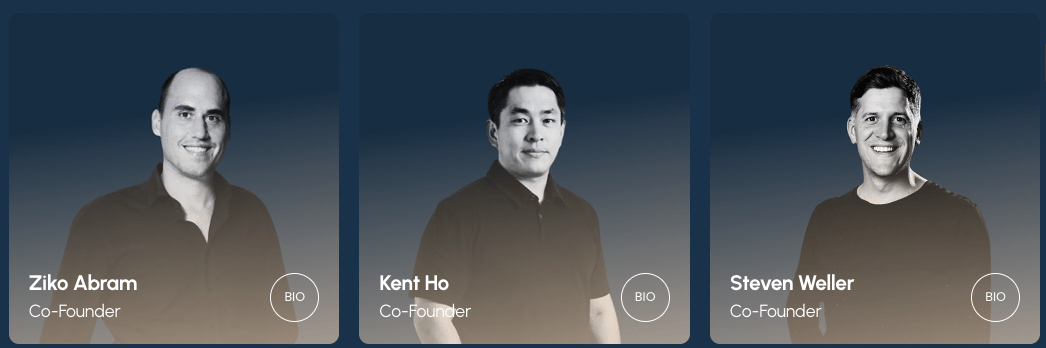

Raptor Collective is the brainchild of Ziko Abram and Kent Ho - two Hong Kong based entrepreneurs. Since neither has software operating experience, they recruited a third co-founder who does. Stephen Weller spent 6 years in the M&A function at Volaris, a division of Constellation Software. It was a long search, and we understand that many of our readers have been in touch with Ziko and Kent.

Source: Raptor Collective

Let’s take a look at Raptor’s Articles of Association to understand the expectations and the division of spoils.